Aerapass Platform: Connecting the World through Cross-Border Fiat and Digital Transactions

In recent years, there has been a significant shift in consumer and business behaviour

towards seeking more efficient, secure, and personalized ways of conducting financial

transactions. The global pandemic further accelerated these trends, prompting a notable move

from cash and in-person payments towards digital and contactless methods. As a response to

this evolving landscape, Aerapass offers a comprehensive payment platform tailored to

address the diverse needs of businesses and consumers alike.

Navigating the Challenges

We understand that transitioning to a digital payment system comes with its challenges.

While traditional payment methods like cash and checks remain deeply ingrained in cultural

practices and business routines, the adoption of digital options can be met with resistance

due to perceived complexities associated with new technologies. At Aerapass, we recognize

the importance of striking a balance and offer solutions that cater to a mix of both fiat

and digital currencies, ensuring flexibility and ease of use for our users.

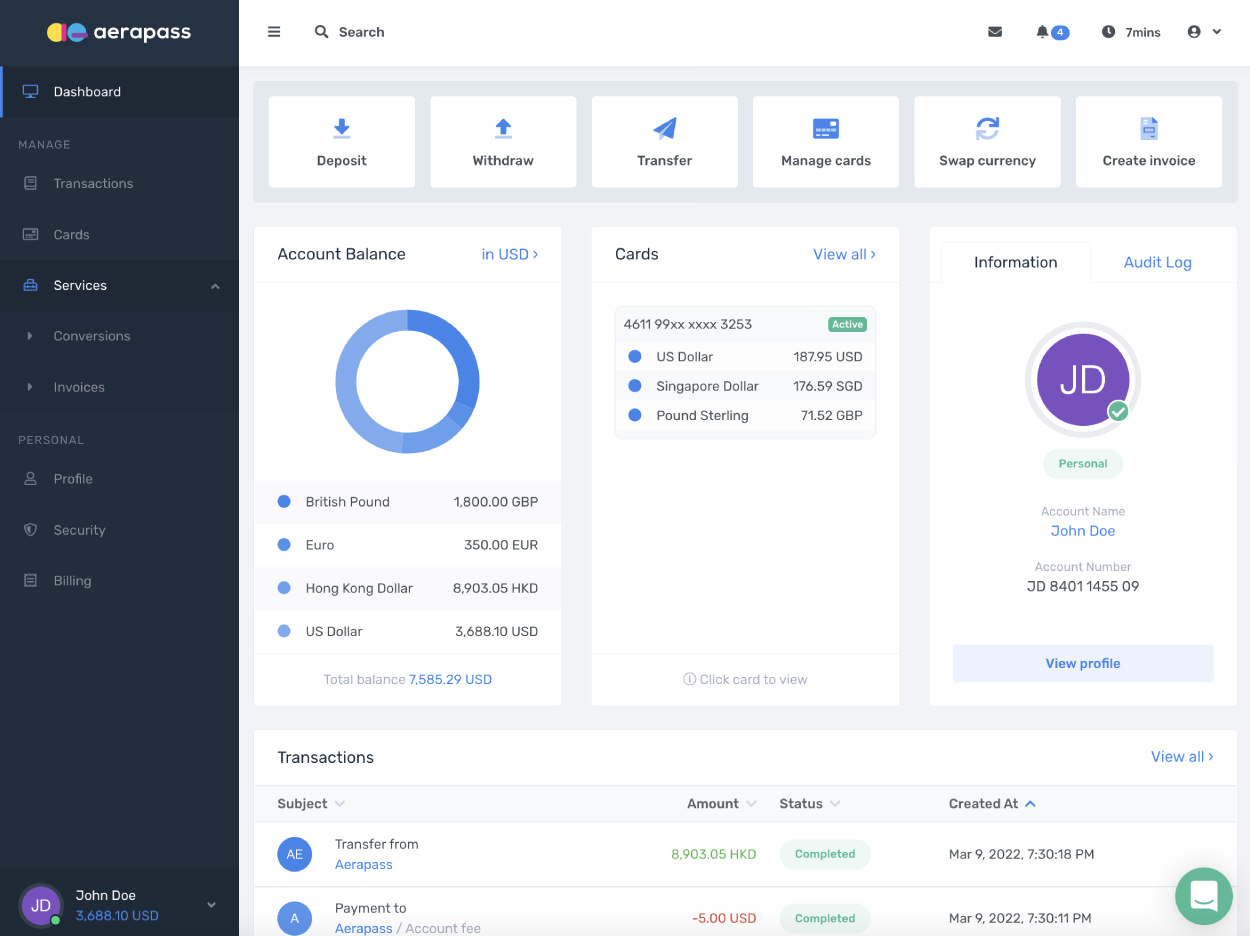

The Versatility of Our Payment Platform

Our payment platform provides a wide array of payment options, from credit cards and debit

cards to mobile payments, digital wallets, and alternative payment methods. As part of our

commitment to innovation, we also embrace the integration of cryptocurrencies within our

digital wallets. This enables users to seamlessly store, manage, buy, and sell digital

assets, all within a unified platform, facilitating a more comprehensive approach to

financial management.

The Benefits of Aerapass Platform

Businesses and consumers alike stand to gain significant benefits from adopting our payment

platform. Some of these advantages include enhanced speed, efficiency, security, and access

to valuable data, ultimately leading to improved sales, customer loyalty, and overall user

experience. At Aerapass, we prioritize security as a paramount concern. Understanding our

customers' concerns about data breaches and identity theft, we have implemented robust

security measures, encryption protocols, and multi-factor authentication to ensure peace of

mind during every transaction.

User-Friendly Interface and Onboarding

We believe that simplicity is key to widespread adoption. To achieve this, we have designed

an intuitive and user-friendly interface for our digital payment platforms, making them

accessible and appealing to all demographics, regardless of technological familiarity.

Additionally, our onboarding process is a step-by-step guide, ensuring users can easily set

up their accounts, make payments, and access transaction history without any hassle.

Financial Inclusion and Innovation

As we look towards the future, Aerapass also focuses on fostering financial inclusion and

innovation. We understand that digital currencies can provide access to financial services

for the unbanked or underbanked population, bridging the financial gap for many individuals

and businesses. Furthermore, we recognize the potential of digital currencies to fuel

financial innovation, enabling new products and services built on blockchain technology.

Aerapass offers a versatile payment platform that caters to the evolving needs of businesses

and consumers alike. We strive to make digital payments seamless, secure, and accessible,

unlocking the potential of a new era in financial transactions. Join us on this journey

towards a digitized future, as we work together to shape a world of frictionless, efficient,

and inclusive financial solutions.