All-in-one fintech platform. Deploy in hours, not months.

Launch private label, compliant financial services with a single modern fintech platform. Aerapass unifies securities, payments, FX, cards and banking into one secure, ISO 27001-ready platform.

Solutions

A modular fintech platform designed for modern financial operations

Aerapass powers fintech startups, challenger banks, wealth managers and cross-border financial service providers with a single, modular platform.

Wealth, Trust & Legal Services

- Trust companies & legal firms

- Family offices

- Wealth managers, IFAs & RIAs

- Escrow and fiduciary service providers

Financial Institutions

- Private banks & credit unions

- Broker-dealers & hedge funds

- Precious metals dealers

- Asset managers & OTC desks

Fintech & Digital Platforms

- Fintech startups & challenger banks

- Payment platforms & card issuers

- Token platforms & VASPs

- Digital asset service providers

The problem

Operational inefficiency slows down financial businesses

Fragmented systems, manual onboarding, and outdated workflows increase cost, slow growth, and introduce risk.

The solution

Unified financial infrastructure to power your business

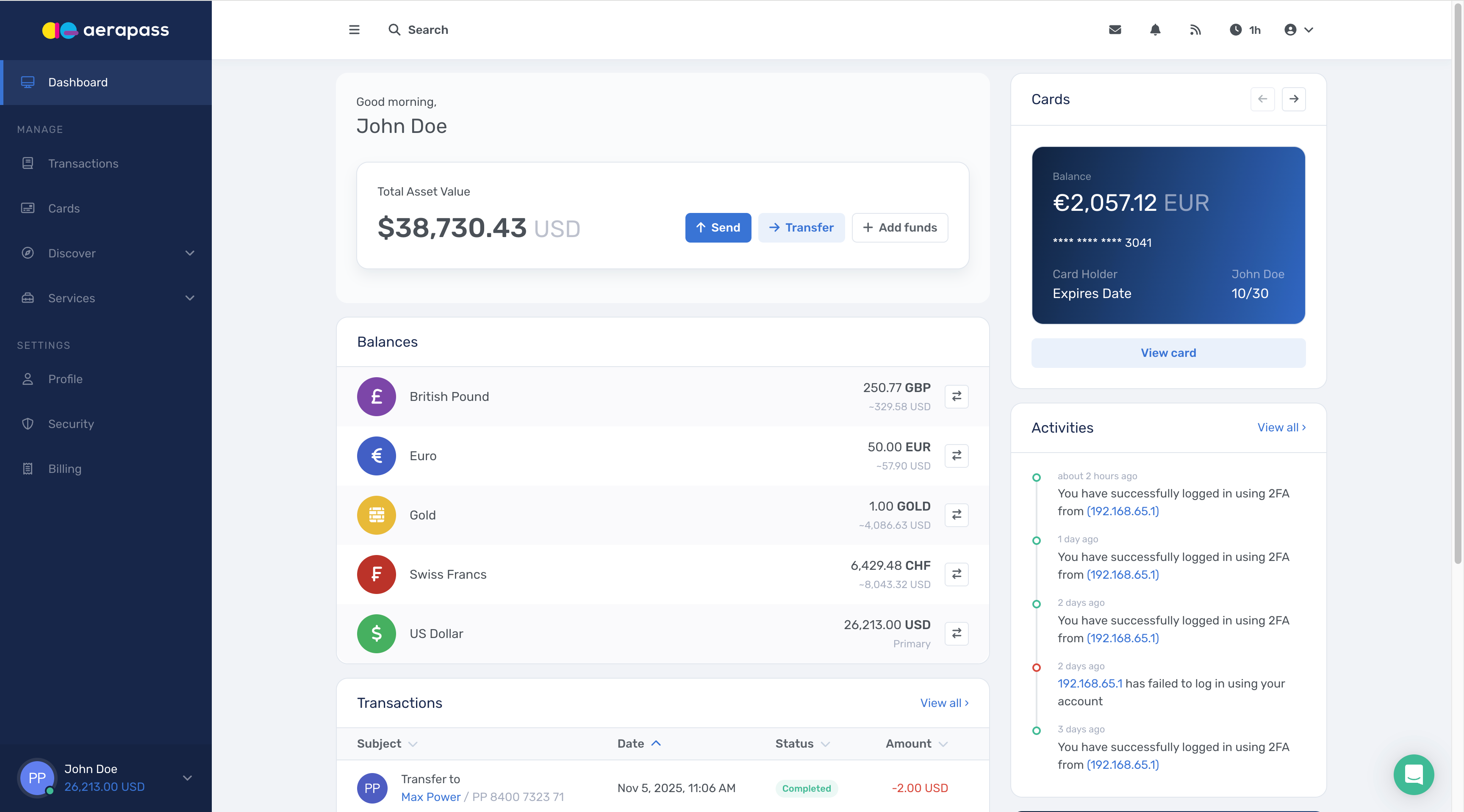

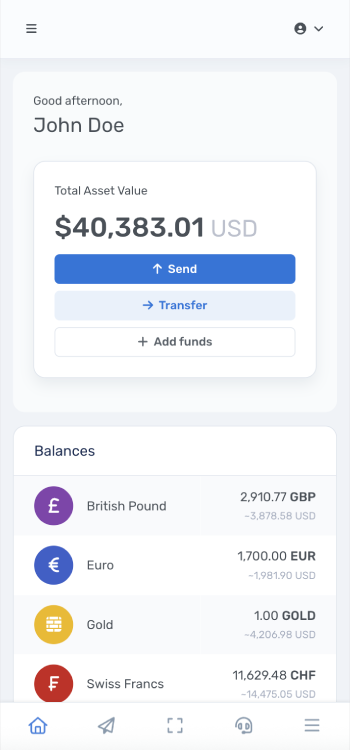

Replace fragmented workflows with a ready-to-use platform for payments, asset management, and global financial operations.Your complete financial services stack to accelerate growth

Consolidate payments, FX, cards, risk assessments and lifecycle management into one deployment-ready platform.

Simplifying business with

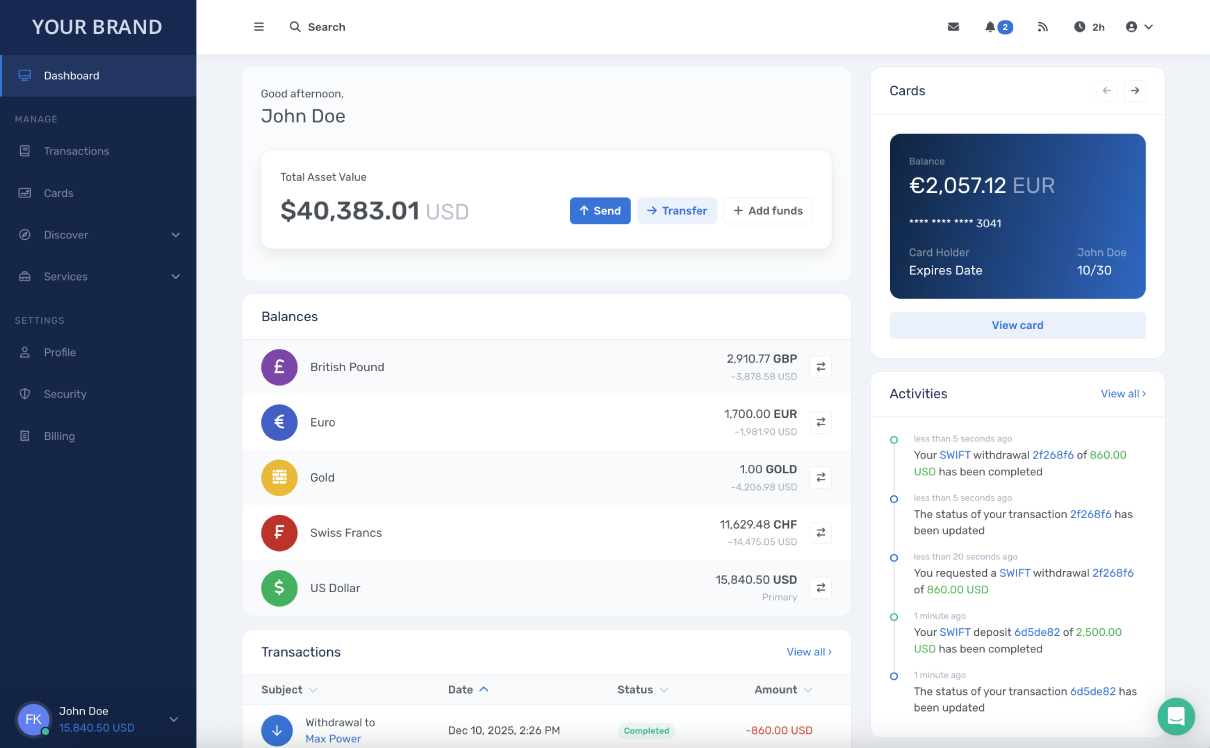

a custom brandable platform.

With your brand at the center, Aerapass delivers a private label fintech platform engineered for smooth operations, seamless customer experiences, and scalable growth.

FEATURES

Powerful capabilities built into every deployment

Everything you need to launch, operate, and scale secure financial services with confidence.

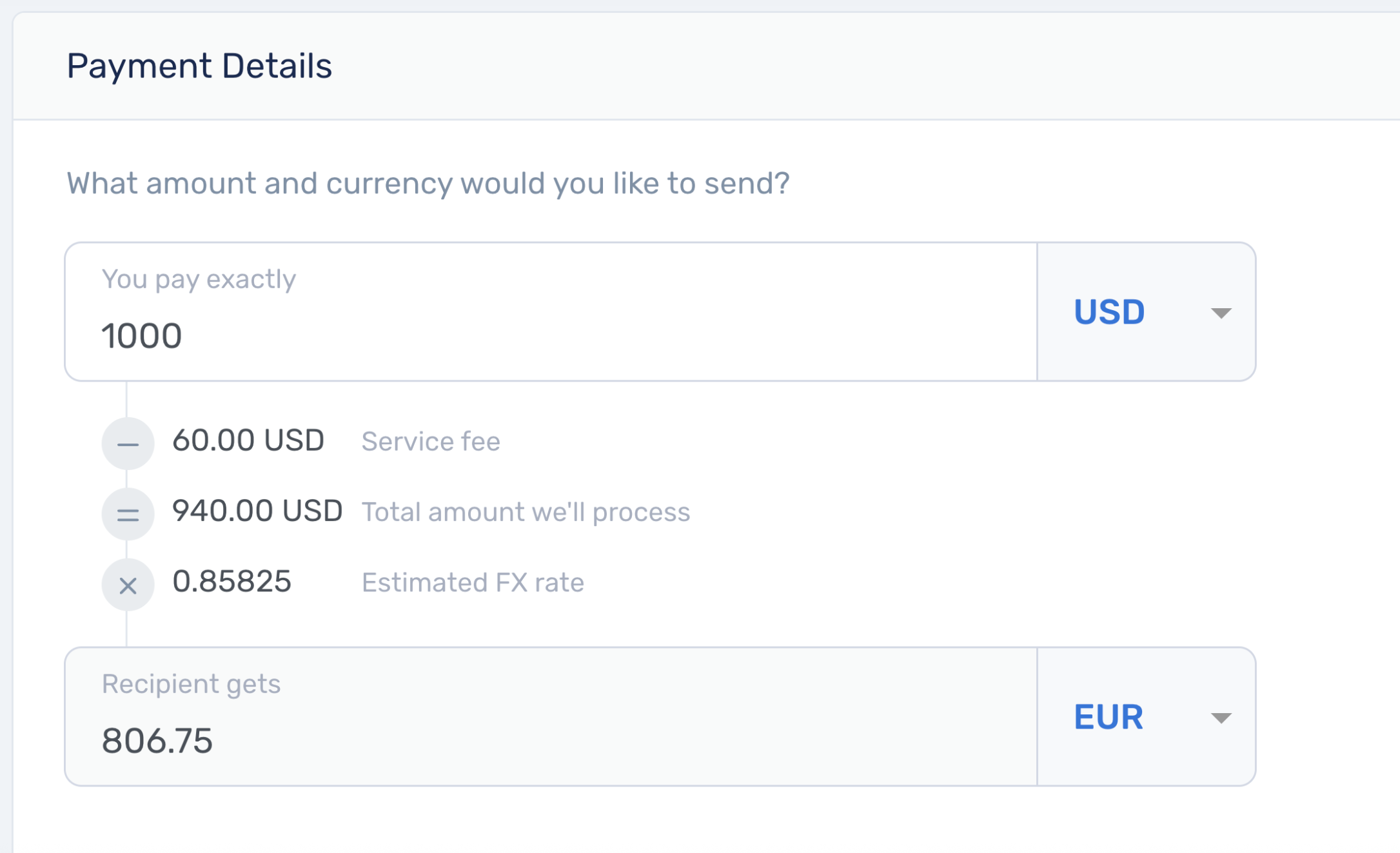

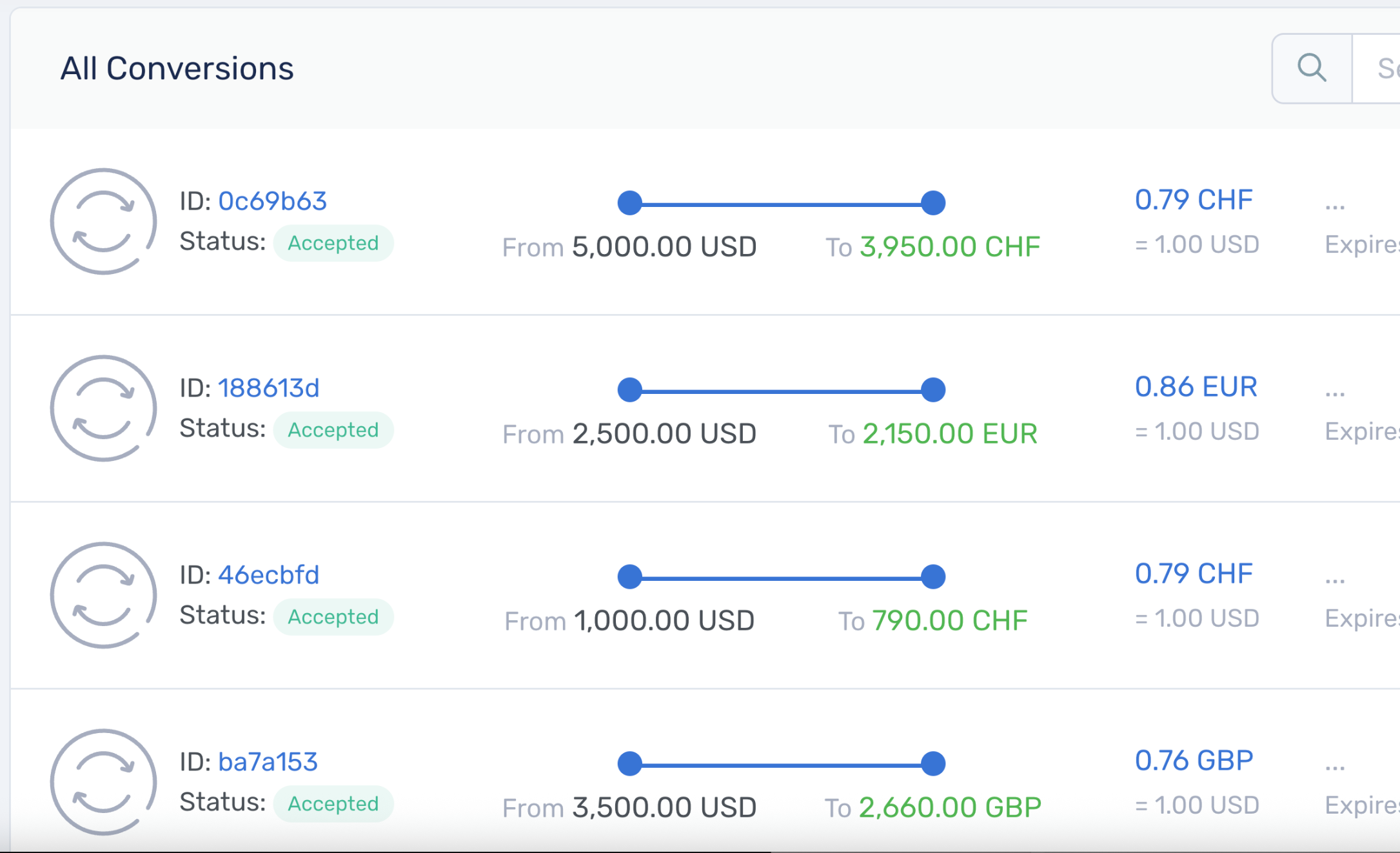

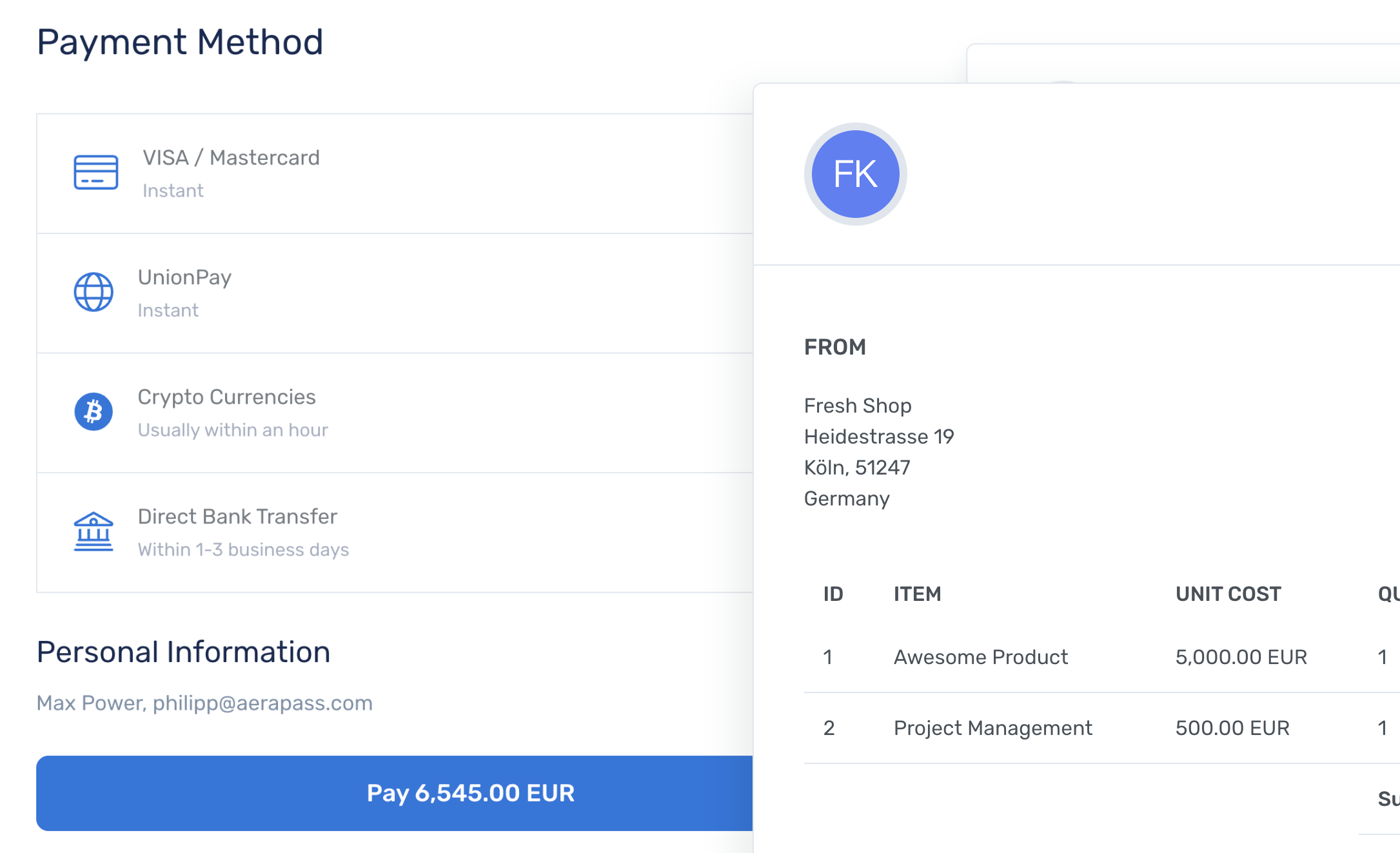

Global payment methods

Support major payment networks and IBAN accounts for secure cross-border transactions.

Customisable workflows

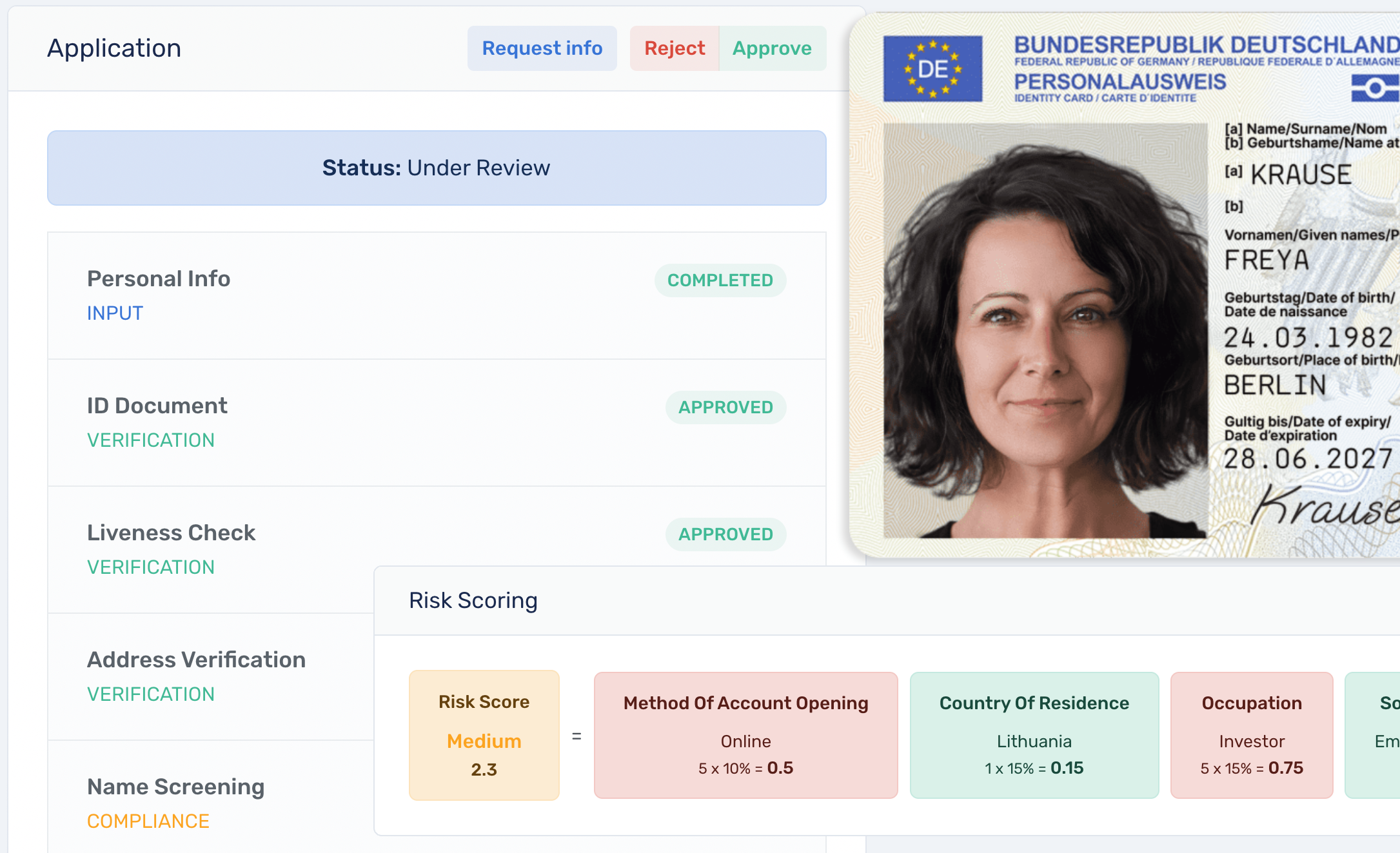

Create onboarding and risk assessment flows integrated with leading data providers.

Back-office dashboard

Gain real-time visibility and control over operations from a single dashboard.

Information security

SOC2/ISO27001-aligned architecture controls deliver the highest standards of information security.

Unified API

Access all Aerapass services through a single API to simplify integration.

Ready to market

Pre-configured financial solutions designed to speed up your go-to-market.

Brand customisation

Launch a private label solution with your own branding and customer experience.

Technical infrastructure

Modern, scalable infrastructure built to support global financial operations.

Security, reliability and compliance

ISO 27001-Aligned Security Controls

SOC 2 Readiness Program

AES-256 Encryption

TLS 1.3 Transport Security

Annual External Penetration Testing

GDPR-Compliant Data Handling

Platform reliability & KYC/AML standards

99.9%+ Uptime

Multi-Region Cloud Hosting (AWS)

Aligned with Wolfsberg Group FCCQ/BCCQ Standards

Following FATF Recommendations

Risk-Based KYC/AML Policies

Campaign

The New Barriers to Global Trade

Western markets are raising digital and regulatory walls, with carbon-linked border tariffs (CBAM) and ESG disclosure embedded in customs and procurement.

Aerapass gives you the infrastructure to break through them, ensuring your goods and capital move across borders without friction.

Read about Project Green Export

Testimonials

Trusted by leading financial innovators around the world

Helping fintechs and financial institutions scale securely with enterprise-grade infrastructure, compliant operations, and proven reliability.

0k+

End users onboarded and retained. Those we serve keep coming back.

0B+

Total assets under administration across traded and non-traded assets.

0%

Guaranteed uptime for all of our services.

★★★★★Aerapass cut our onboarding time from weeks to under 48 hours, eliminating over 20 manual steps per client. They have been an invaluable collaborative partner for Riverside Trustees.

★★★★★We experienced 15x volume increase thanks to Aerapass. I highly recommend their platform to any business seeking a scalable payment platform to power their financial services.

★★★★★In 5+ years on Aerapass, we’ve had 0 operational outages and processed tens of thousands of transactions without disruption. I feel comfortable continuing to use Aerapass and I highly recommend it.

★★★★★Their platform shaved 6 months off our launch timeline and saved us hundreds of development hours, giving us a faster and stronger market entry. I cannot thank Frank and the Aerapass team enough for their support.

Frequently Asked Questions

Common questions about platform

Learn how we help fintechs and financial institutions launch secure, compliant financial services at speed and scale.

Aerapass is an all-in-one fintech platform that consolidates payments, FX, cards, wealth services, and customer lifecycle management into a single, deployment-ready infrastructure.

Unlike traditional providers, Aerapass integrates onboarding, compliance, risk workflows, and operational tools under one unified API, reducing technical overhead and accelerating time to market.

Our platform is built for fintechs and financial institutions that need secure, scalable, and regulatory-ready financial services with minimal engineering effort.

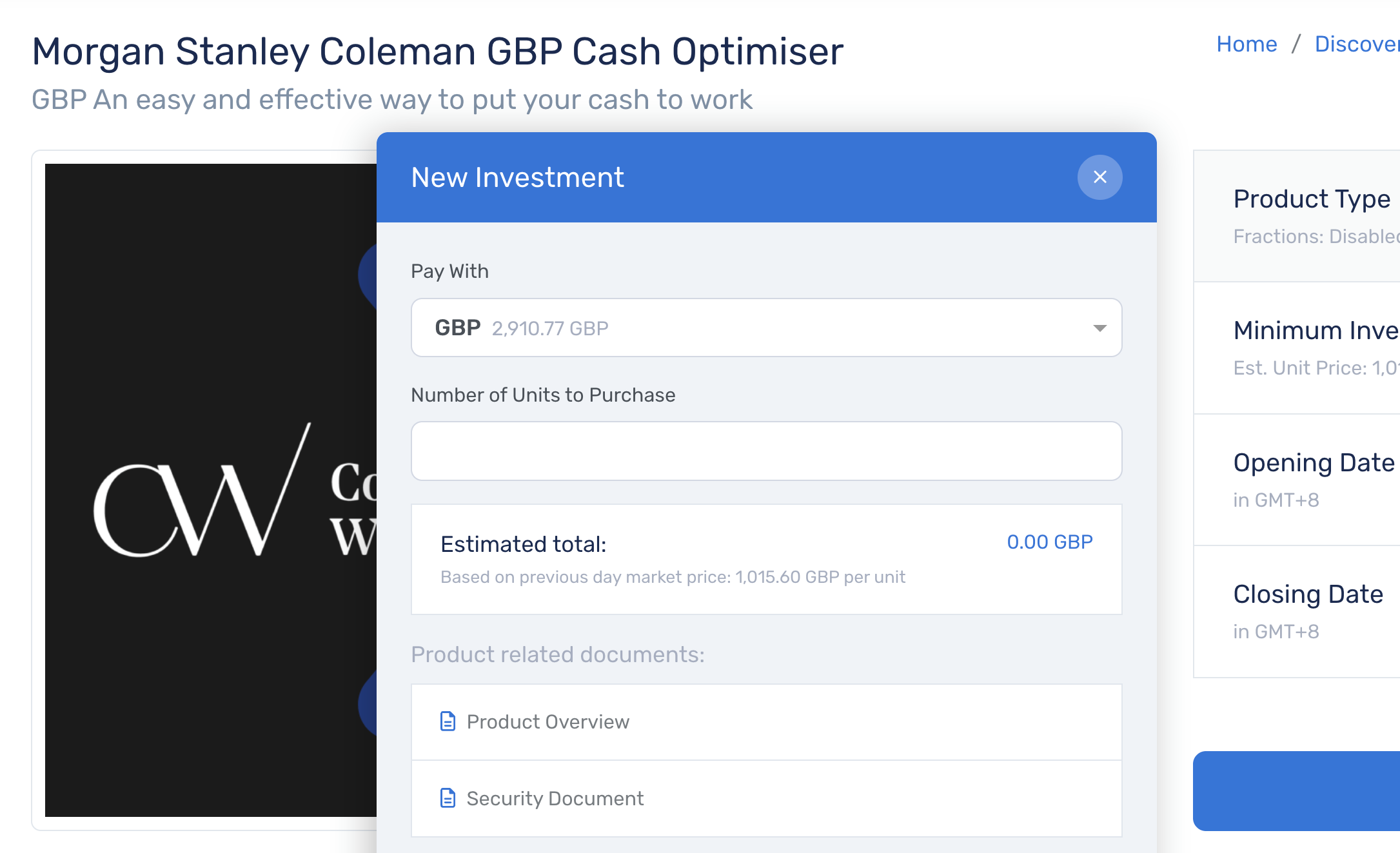

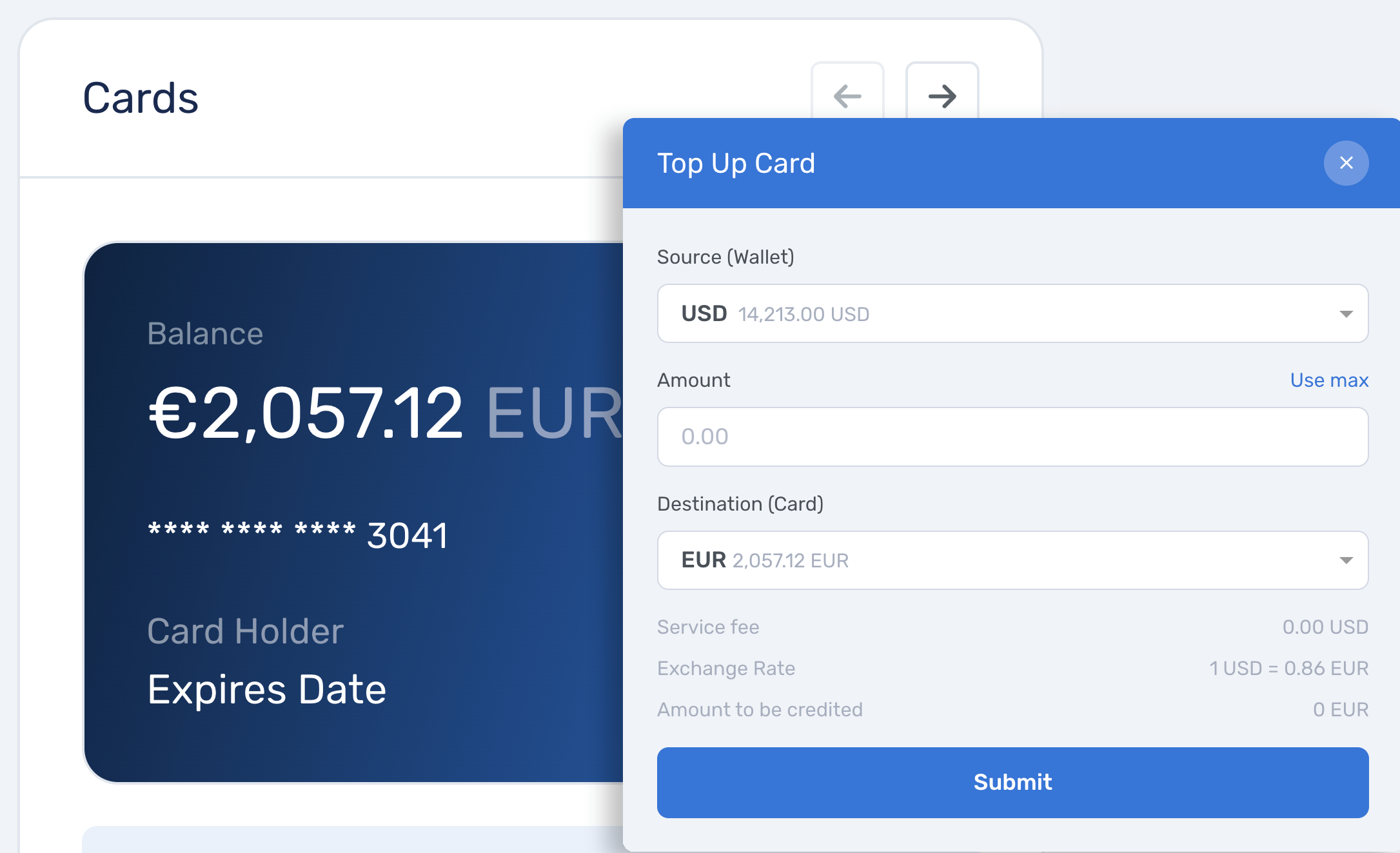

Aerapass offers a comprehensive suite of financial solutions including integrated payments processing, foreign exchange (FX) services, card capabilities, and wealth management tools.

Our platform supports major payment networks and provides seamless IBAN account solutions for secure transactions. Additional services include customisable onboarding and risk assessment flows, lifecycle management tools, and real-time back-office dashboard capabilities.

All solutions are accessible through a unified API and designed to streamline transactions with flexibility and speed to market.

Aerapass is designed for rapid deployment. Most financial services can be launched in as little as 48 hours, thanks to our pre-configured, modular infrastructure.

Our unified API, ready-to-market components, and simplified onboarding workflows significantly reduce development time compared to traditional integrations.

This allows fintechs and financial institutions to launch compliant financial products without lengthy build cycles.

Aerapass includes built-in onboarding and compliance workflows that automate KYC, KYB, and AML checks.

Our system integrates with trusted identity and risk-assessment providers, enabling you to verify customers quickly while meeting regulatory standards.

You can customise these workflows to match your compliance requirements, reducing operational overhead and maintaining a seamless customer experience.

Yes. Aerapass follows strict information-security and regulatory standards, including ISO aligned security controls.

Our infrastructure uses advanced encryption, multi-layer access controls, continuous monitoring, and industry-standard data protection practices.

We support regulated institutions and maintain compliance across payments, FX, cards, and wealth services to ensure safe and reliable operations.

Yes. Aerapass offers a unified API that allows seamless integration with your existing systems, workflows, and third-party services.

Our modular design enables you to adopt only the products and capabilities you need, without restructuring your current infrastructure.

This flexibility makes it easy to scale, extend functionality, and reduce implementation time.

Book a meeting

Schedule a Live Demo

Discover how Aerapass can consolidate your payments, FX, cards, and wealth operations into one secure financial platform.