Platform > Module

Customer Management

The foundational layer everything in Aerapass is built on to manage customer identity, risk, and compliance across onboarding, monitoring, changes, and exit.

The challenge

Manual compliance is a time drain

Spreadsheets and disconnected tools make it difficult to maintain a single source of truth for customer identity, risk, and compliance.

Meet Aerapass

All-in-one customer management with lifecycle controls built-in

Centralize identity, risk, and compliance in one layer that manages customers from onboarding through monitoring, changes, and exit.

Built for financial institutions, like you

Customer onboarding overview

| Customer type | Onboarding time | What we verify |

|---|---|---|

| Individuals | 2-5 minutes (fully automated) Longer if information is incomplete | Identity verification Name & sanctions screening Address validation Document authenticity checks |

| Business accounts | 5-15 minutes (fully automated) 1-3 business days if additional review is required | Company registration lookup UBO discovery & ownership mapping Director & shareholder verification Name & sanctions screening Business activity validation |

| Trust accounts | 10-20 minutes (fully automated) 1-3 business days if data is incomplete or manual review is needed | Trust structure analysis Trustee, settlor & beneficiary verification Control & ownership assessment Name & sanctions screening |

Onboarding times depend on jurisdiction, data availability, and customer complexity.

What you get

Reclaim your team's time, automate compliance and more

Replace manual processes with a unified customer layer that enforces consistent controls across the lifecycle.

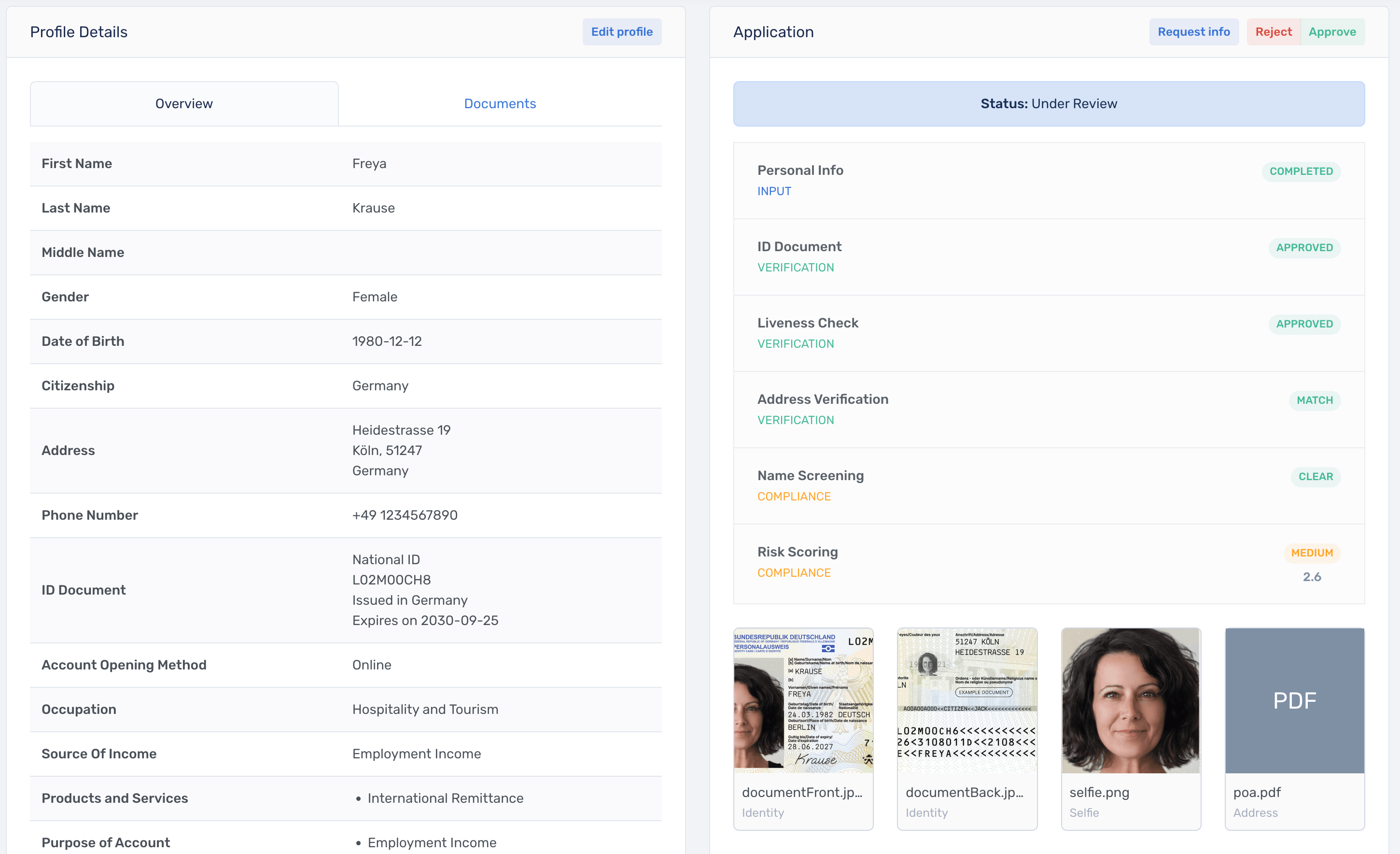

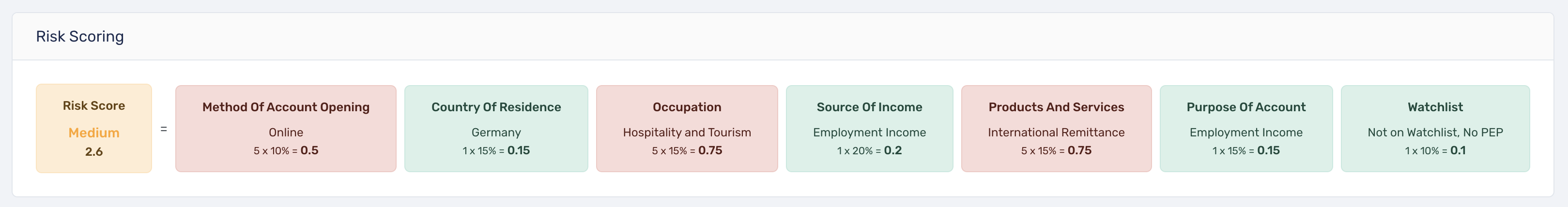

Risk scoring

Real-time risk scoring & automated decision-making

Built-in risk assessment capabilities adapt as customer behavior changes throughout their lifecycle, enabling faster decisions while maintaining strict compliance standards across all platform modules.

Frequently Asked Questions

Common questions about Customer Management

Aerapass Customer Management is the foundational customer layer everything in Aerapass is built on. It manages customer identity, risk, and compliance across the full lifecycle, from onboarding through ongoing monitoring, changes, and exit.

AML screening, KYC, transaction monitoring, and documentation are embedded capabilities inside this layer, ensuring every customer state is controlled and auditable by default.

Aerapass is designed to operate across major offshore and international banking jurisdictions, including the Cayman Islands, British Virgin Islands, Switzerland, and others.

The platform includes built-in multi-jurisdiction compliance frameworks that adapt customer onboarding, AML, and KYC requirements based on where you operate. This allows you to serve clients across different regions without maintaining separate systems or manually adjusting workflows.

Yes. Aerapass is built to align with FATF (Financial Action Task Force) standards and adapt to regional regulatory requirements across multiple markets.

Customer Management automatically adjusts AML screening, KYC checks, and monitoring logic based on jurisdiction, so you can expand into new regions without redesigning your customer or compliance workflows.

Aerapass Customer Management is used by a wide range of financial institutions, including:

- Fintechs and neobanks

- Payment institutions

- Private banks and wealth managers

- Trust and corporate service providers

- Asset managers and investment firms

- Crypto and digital asset businesses

Whether you are onboarding high-net-worth individuals, managing complex entity structures, or serving institutional clients, Customer Management provides a consistent customer control layer.

Transactions are evaluated in real time against your risk rules, policies, and monitoring models. Each transaction is automatically scored for potential money laundering, sanctions exposure, and suspicious activity. If a risk threshold is breached, your team receives immediate alerts with full context so investigations can start before settlement completes.

The system continuously learns from investigation outcomes and can be tuned to reduce false positives over time.

Yes. Aerapass is designed to scale from early-stage institutions to large, high-volume operations.

You get enterprise-grade customer and compliance capabilities from day one, without the enterprise-level complexity. As your institution grows, Customer Management scales with you, without migrations or rebuilding your customer infrastructure.

Yes. Aerapass is well suited for private banking and wealth management use cases.

Customer Management supports complex ownership structures, trusts, family offices, and high-net-worth individuals while automating onboarding, KYC, ongoing monitoring, and documentation. This allows your teams to focus on client relationships instead of manual compliance work.

Customer Management automates customer-related compliance workflows end-to-end. AML, CTF (Counter-Terrorism Financing), KYC, and monitoring processes run continuously in the background across onboarding and ongoing activity. Suspicious patterns are flagged in real time, and every check, decision, and investigation is recorded automatically.

This creates a complete audit trail that is always ready for internal reviews and regulators.

Aerapass is built to meet international AML standards, including FATF recommendations and Wolfsberg Group FCCQ (Financial Crime Compliance Questionnaire) and BCCQ (Business Corruption Compliance Questionnaire) requirements.

The platform is designed to support audits in highly regulated jurisdictions and helps institutions meet regulatory requirements across multiple markets simultaneously.

Customer Management is the foundation for the Aerapass platform.

Payments, Cards, Wallets, Treasury, and other modules rely on the same customer profiles, risk states, and compliance controls. This ensures consistent decisions and a single source of truth across all products.

Yes. You can configure risk scoring models, thresholds, rules, and workflows to match your internal policies and regulatory requirements.

This includes automated decisions, manual review steps, escalation paths, and approval logic.

Yes. Every customer action, check, decision, and investigation is logged automatically.

Customer Management generates real-time audit trails and reporting that support regulatory examinations, internal audits, and ongoing compliance monitoring.

Discover the Aerapass platform

Book a meeting

Schedule a Live Demo

Discover how Aerapass can consolidate your payments, FX, cards, and wealth operations into one secure financial platform.