Platform > Module

Wealth Management

Unified securities infrastructure for traditional, digital, and tokenised assets. Issue, manage, and distribute investment products globally from one secure platform.

THE CHALLENGE

Legacy platforms weren't built for modern wealth products

Most wealth technology stacks were designed for a single asset class. As new formats emerge, firms are forced to bolt on systems, duplicate processes, and rebuild infrastructure.

MEET AERAPASS

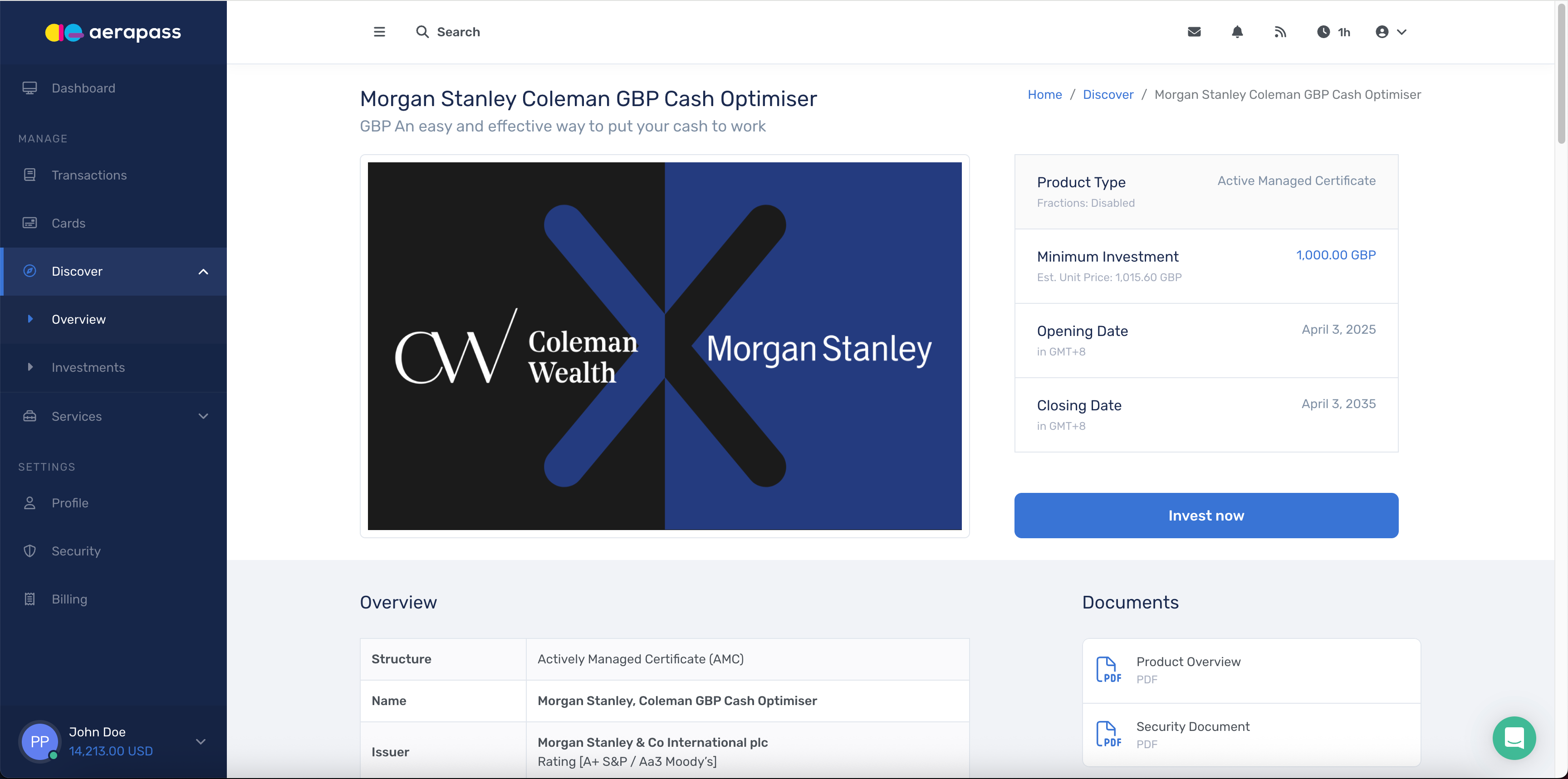

Every asset format. One platform.

Aerapass natively supports traditional, digital, and tokenised securities within a single issuance and distribution framework, connected to global wealth hubs and offshore banking centres.

Built for wealth managers, like you

Asset coverage overview

| Asset type | Issuance format | Distribution model | Typical use cases |

|---|---|---|---|

| Traditional securities | Paper-based or electronic | Direct or intermediary-led | Public and private market offerings |

| Digital securities | Digitally native instruments | Platform-based distribution | Faster settlement, broader accessibility |

| Tokenised securities | Blockchain-based representations | Fractional or full ownership | Fractional investing, liquidity access |

| Fractionalised assets | Unitised or tokenised | Broad investor reach | Lower entry thresholds |

Designed for institutions seeking flexible issuance models across traditional and digital markets.

WHAT YOU GET

Scale without limits

Manage all asset classes, traditional, digital, and tokenised, under a single compliance and operational framework. Instantly onboard, issue, and distribute new assets worldwide on one trusted network.

Frequently Asked Questions

Common questions about Wealth Management

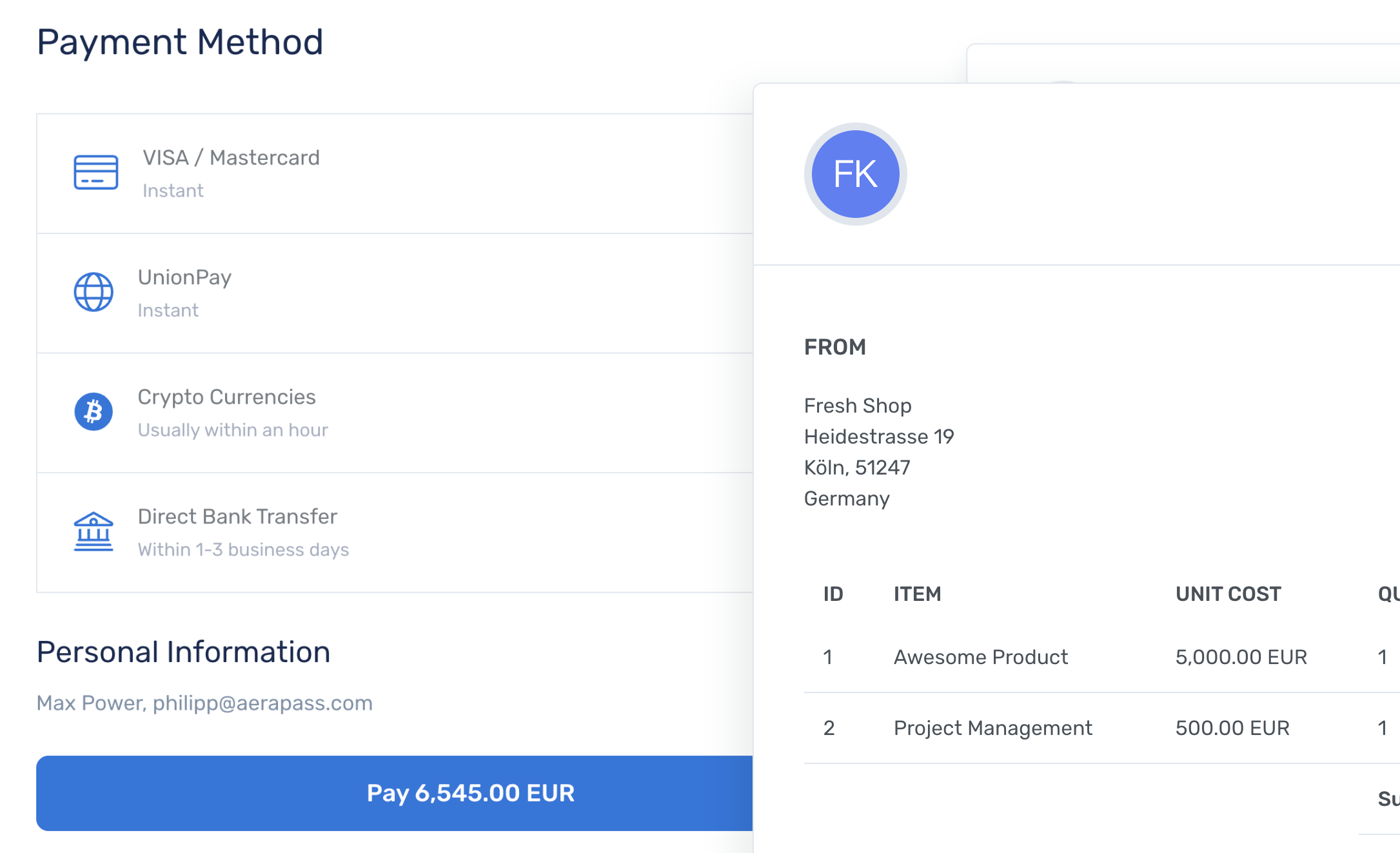

Wealth Management in Aerapass lets you issue, manage, and distribute traditional, digital, and tokenised securities on one unified platform.

You can administer all asset classes, from equity and debt to tokenised real estate and fractionalised ownership, through a single distribution network, while maintaining unified compliance and operations across markets.

Traditional securities rely on conventional custody, settlement, and record-keeping systems operated by established financial institutions.

Tokenised securities use blockchain-based infrastructure for ownership records, enabling faster settlement, enhanced transparency, and programmable features. Aerapass supports both formats through unified processes, allowing you to choose the format that best fits each product.

Legacy platforms typically support traditional securities only. Adding digital or tokenised assets requires separate systems and complex integrations.

Aerapass supports all asset formats natively through one infrastructure, so you can manage traditional securities, digital certificates, and tokenised assets from a single platform without additional systems.

Yes. You can issue securities once and distribute them to wealth management centres globally.

The platform supports jurisdiction-specific regulatory requirements while maintaining a unified issuance workflow, reducing the need for multiple parallel structures.

Yes. Smaller firms can access institutional-grade infrastructure regardless of assets under management.

You can start with basic issuance and distribution capabilities and expand into advanced features like tokenisation and fractionalisation as your business grows.

The platform is designed to support Swiss private banks, family offices, and asset managers with multi-asset capabilities aligned to high regulatory standards.

It enables Swiss institutions to manage both traditional and modern asset classes efficiently while supporting complex wealth structures and cross-border distribution.

The platform supports:

- Equity, debt, and investment funds

- Digital securities and certificates

- Tokenised real estate and private market assets

- Fractionalised alternatives

- Unitised and structured investment products

This coverage allows wealth managers to offer diverse investment options from one platform.

Fractionalisation divides large assets into smaller ownership units, making high-value investments accessible to more investors.

The platform automatically manages ownership records, distributions, and investor communications throughout the asset lifecycle.

Yes. The platform supports sustainability credentials and ESG data across traditional and tokenised assets.

You can provide transparent reporting for impact and sustainability-focused portfolios.

No. Aerapass does not impose artificial minimums or maximums.

Issuance size depends on product design, jurisdictional requirements, and distribution strategy rather than platform limitations.

Yes. Depending on the asset type and market, securities can be distributed through real-time execution or OTC workflows.

Both models are supported within the same platform.

Custody models vary by asset type and jurisdiction.

Aerapass integrates with regulated custodians and infrastructure providers to support both traditional custody and digital asset custody under compliant frameworks.

Yes. Aerapass provides APIs and integration tooling to connect with portfolio management systems, core banking platforms, and compliance systems.

The platform supports the full lifecycle:

Issuance → Distribution → Ownership tracking → Corporate actions → Reporting → Redemption / maturity.

Discover the Aerapass platform

Book a meeting

Schedule a Live Demo

Discover how Aerapass can consolidate your payments, FX, cards, and wealth operations into one secure financial platform.