Platform > Module

Multi-Asset Exchange

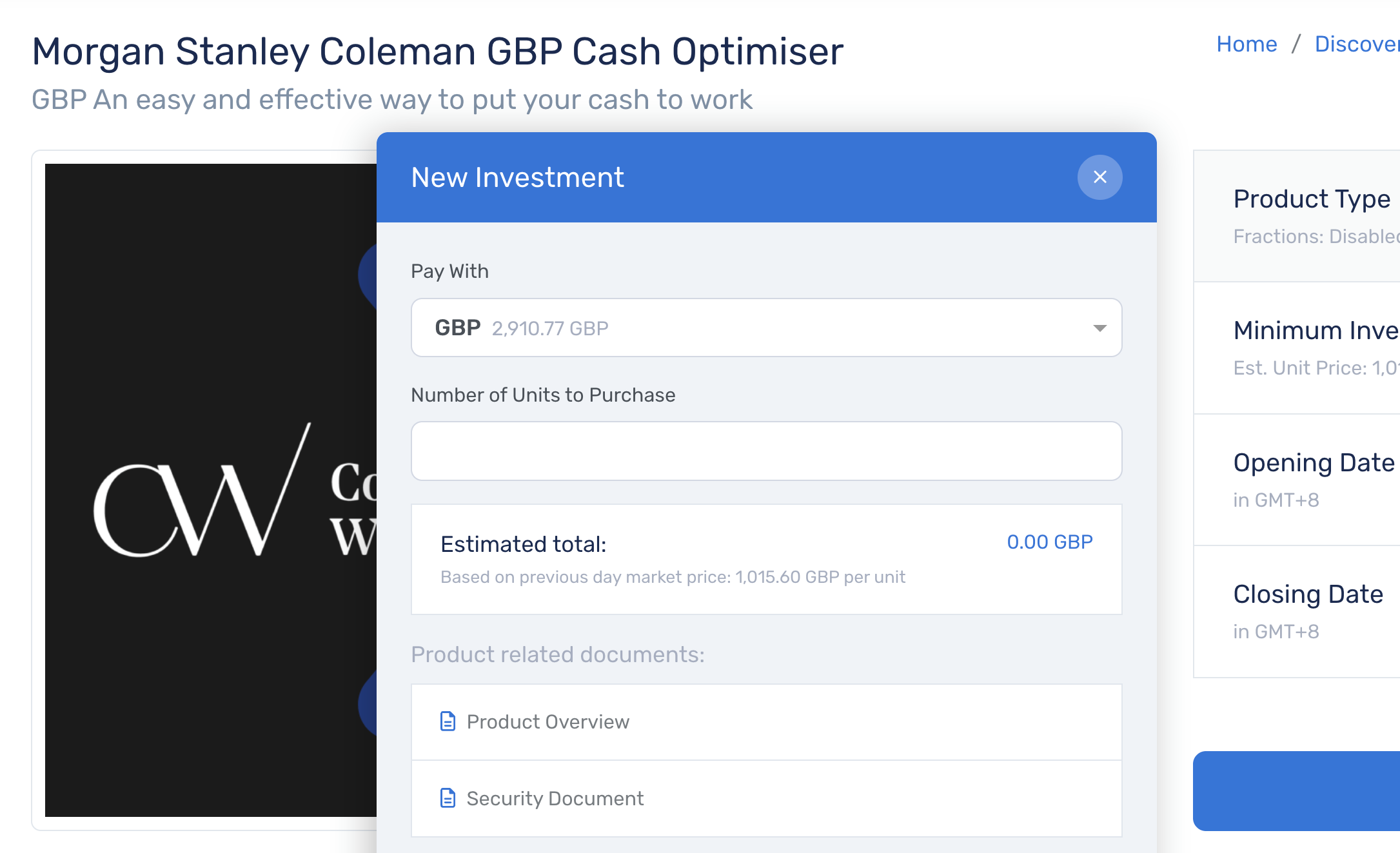

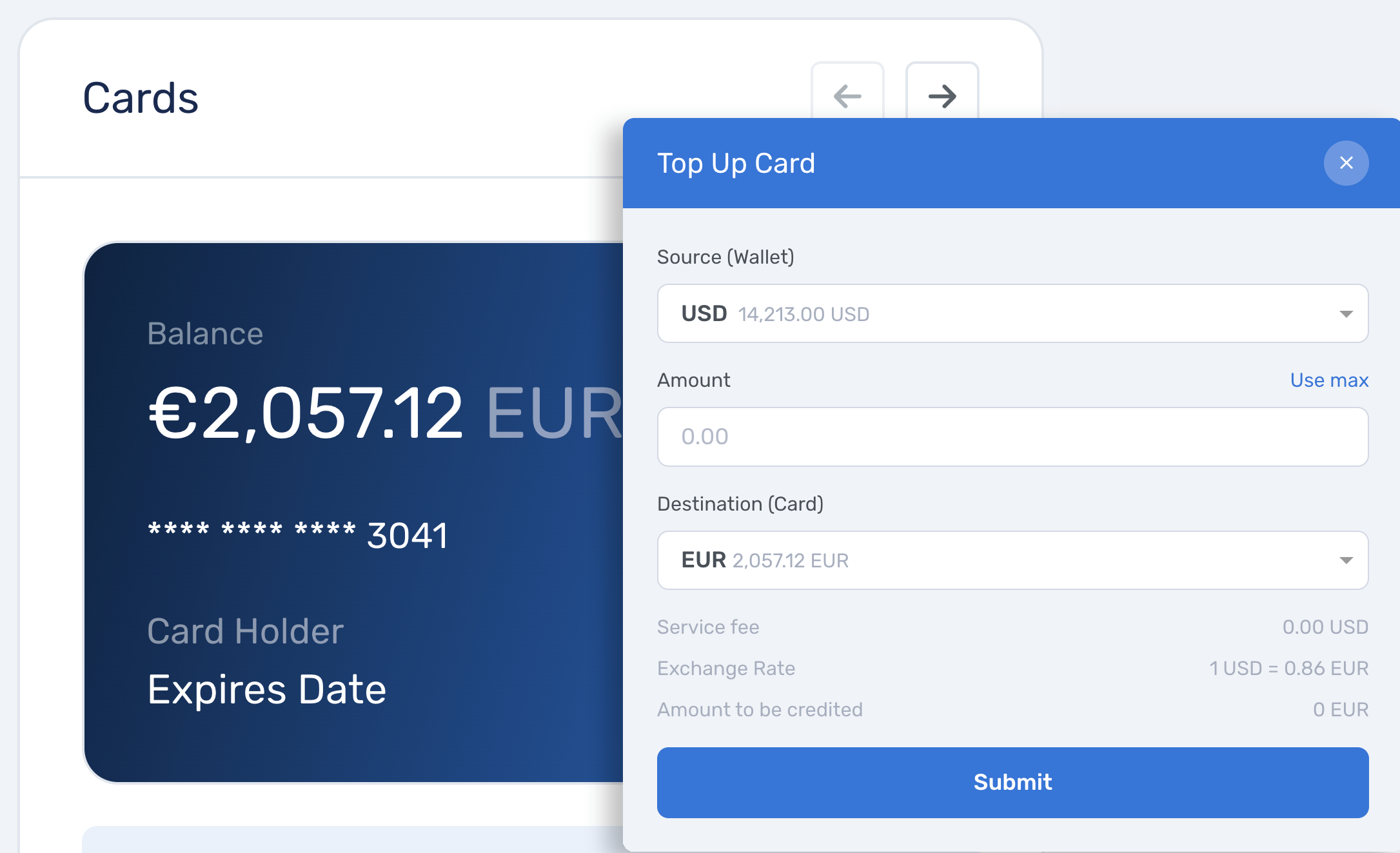

Trade and convert fiat currencies, digital assets, and precious metals with real-time pricing or OTC execution from one unified platform.

The challenge

Slow execution costs you money

When your platform lags, the rate you want is not the rate you get. Delays, stale quotes, and manual processes erode margins and increase operational risk.

Meet Aerapass

Institutional multi-asset trading infrastructure

Access real-time markets and OTC execution across fiat, digital assets, and precious metals. Choose the right execution model based on asset type, size, and liquidity. All available in one platform.

Built for professional trading and treasury teams, like yours

FX & asset conversion coverage

| Asset type | Supported instruments | Common conversion pairs | Typical availability |

|---|---|---|---|

| Fiat currencies | Major & regional currencies | EUR/USD, GBP/USD, EUR/GBP, local | Live pricing |

| Digital assets | Supported digital assets | Crypto-fiat, crypto-crypto | Near real-time / OTC |

| Precious metals | Gold, Silver | Metal-fiat | Market hours / OTC |

| Cross-asset | Fiat, digital assets, metals | Fiat-crypto, fiat-metal, crypto-metal | Live to near real-time / OTC |

Instrument availability and pricing depend on market conditions and liquidity providers.

What you get

Enterprise-grade execution

Trade across asset classes with institutional liquidity, flexible execution models, and predictable outcomes.

Frequently Asked Questions

Common questions about Multi-Asset Exchange

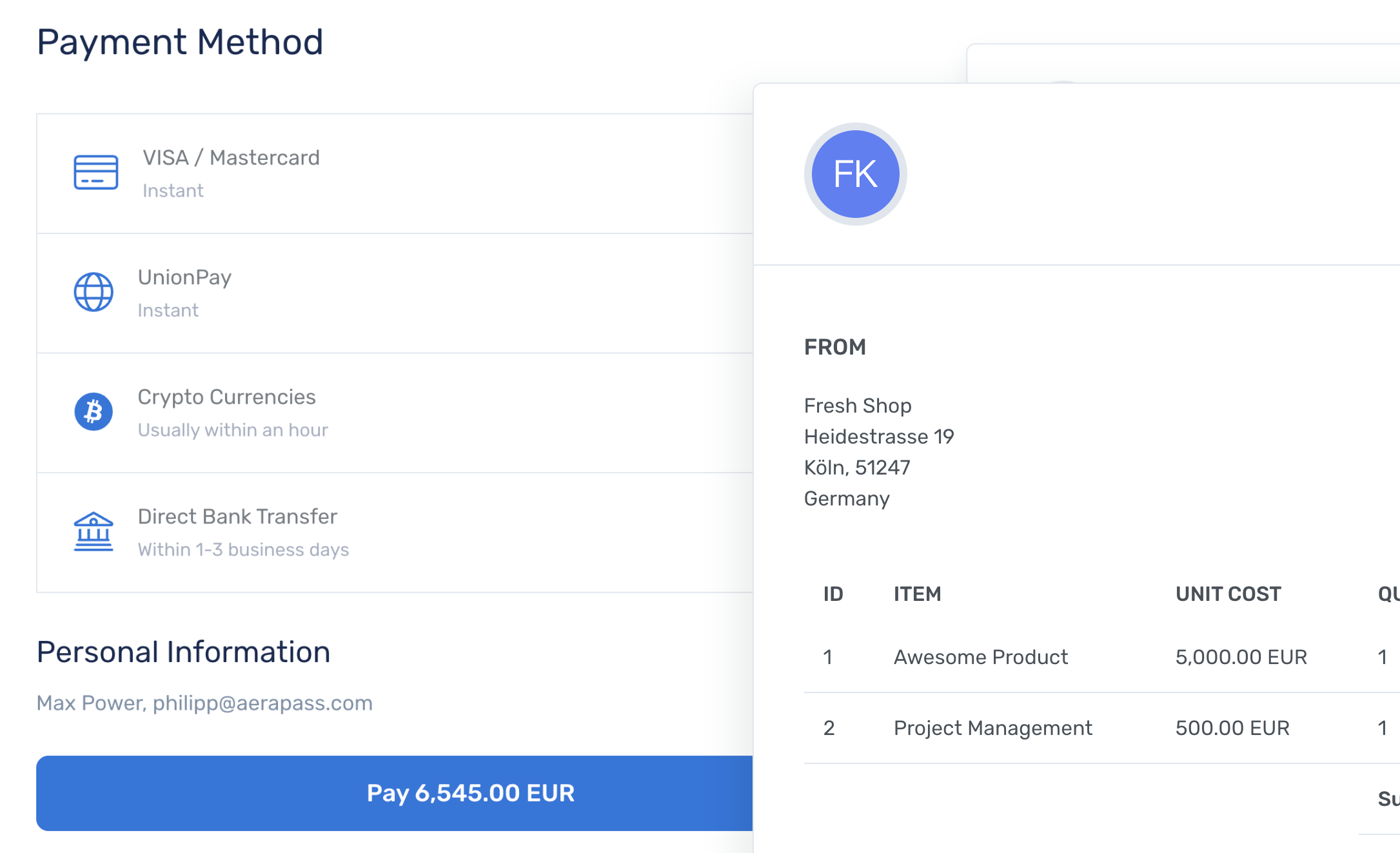

Multi-Asset Exchange in Aerapass lets you trade and convert fiat currencies, digital assets, and precious metals from a single platform.

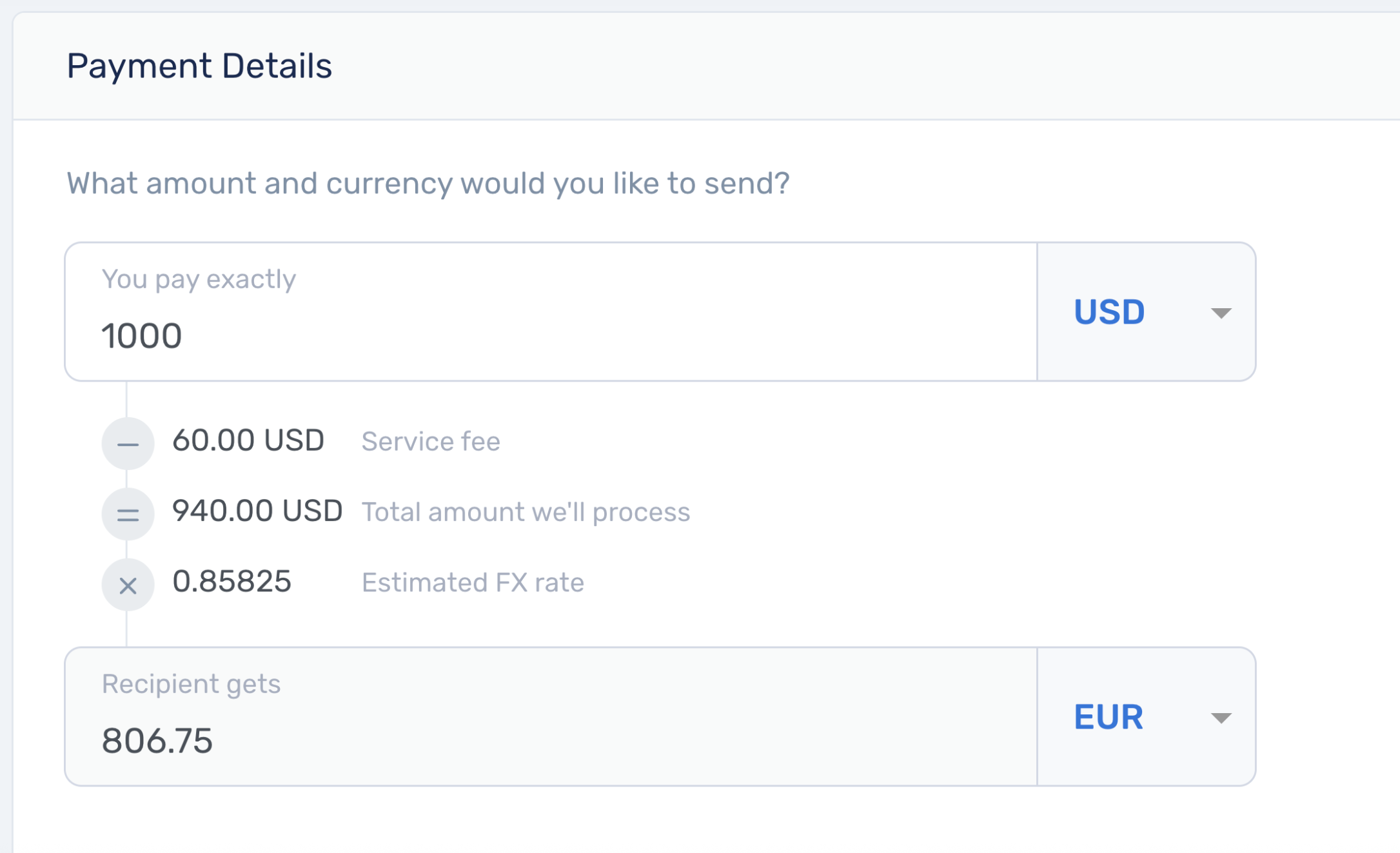

You can execute trades using real-time market pricing or OTC execution, depending on the asset, size, and liquidity conditions. This ensures consistent execution quality across all supported asset classes.

Fiat FX trading is available 24 hours during global FX market hours, aligned with Hong Kong business days and liquidity provider availability.

Digital asset markets operate 24/7. Precious metals trading follows relevant market hours or OTC availability. Execution windows depend on asset type and liquidity conditions.

Real-time trades execute in milliseconds with continuously updating prices.

OTC trades are quoted and confirmed directly with liquidity providers or trading desks and typically complete within minutes. You always see the final executable price before confirming the trade.

Many platforms display indicative or delayed prices. Aerapass shows live executable prices sourced from multiple liquidity providers.

The price displayed is the price you trade at, without requotes or post-confirmation adjustments.

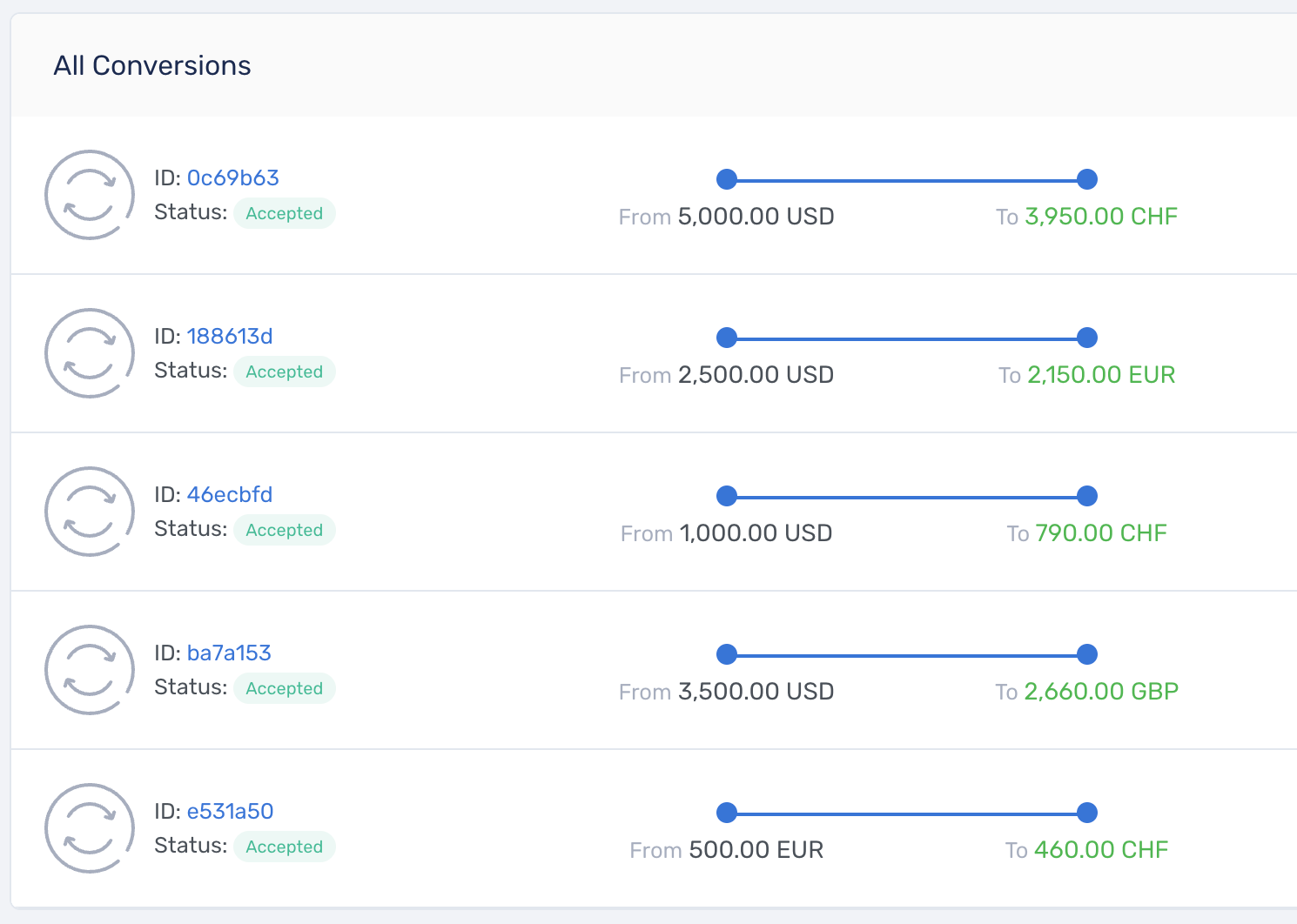

OTC (over-the-counter) trading is used for larger, illiquid, or complex trades that are better handled outside public order books.

OTC execution provides relationship-based pricing, tailored settlement options, and reduced market impact. It is commonly used for large FX conversions, digital asset trades, precious metals, and non-standard pairs.

No. Aerapass does not impose artificial minimum or maximum trade sizes.

Trades are routed to real-time or OTC execution based on asset type, size, and liquidity conditions to ensure optimal execution quality.

- Fiat currencies

- Digital assets

- Precious metals (e.g., gold, silver)

- Cross-asset conversions between fiat, digital assets, and metals

Asset availability depends on jurisdiction and liquidity provider coverage.

You can trade major, minor, cross, and selected exotic FX pairs.

Digital asset and precious metals pairs are supported against major fiat currencies and, where available, against each other.

Yes. Smaller businesses can access the same execution infrastructure used by institutional clients.

You can start with real-time execution and use OTC as needed. Pricing and execution models scale with your activity.

Yes. Aerapass provides API-based access to pricing, execution, balances, and trade reporting.

You can integrate Multi-Asset Exchange into your existing trading, treasury, or back-office workflows.

Aerapass aggregates liquidity from multiple global providers across asset classes.

This provides access to institutional liquidity pools and enables efficient execution for both real-time and OTC trades.

Yes, physical delivery for currencies and precious metals is supported in selected markets.

Availability and timelines depend on the asset and destination. The platform coordinates settlement and delivery workflows.

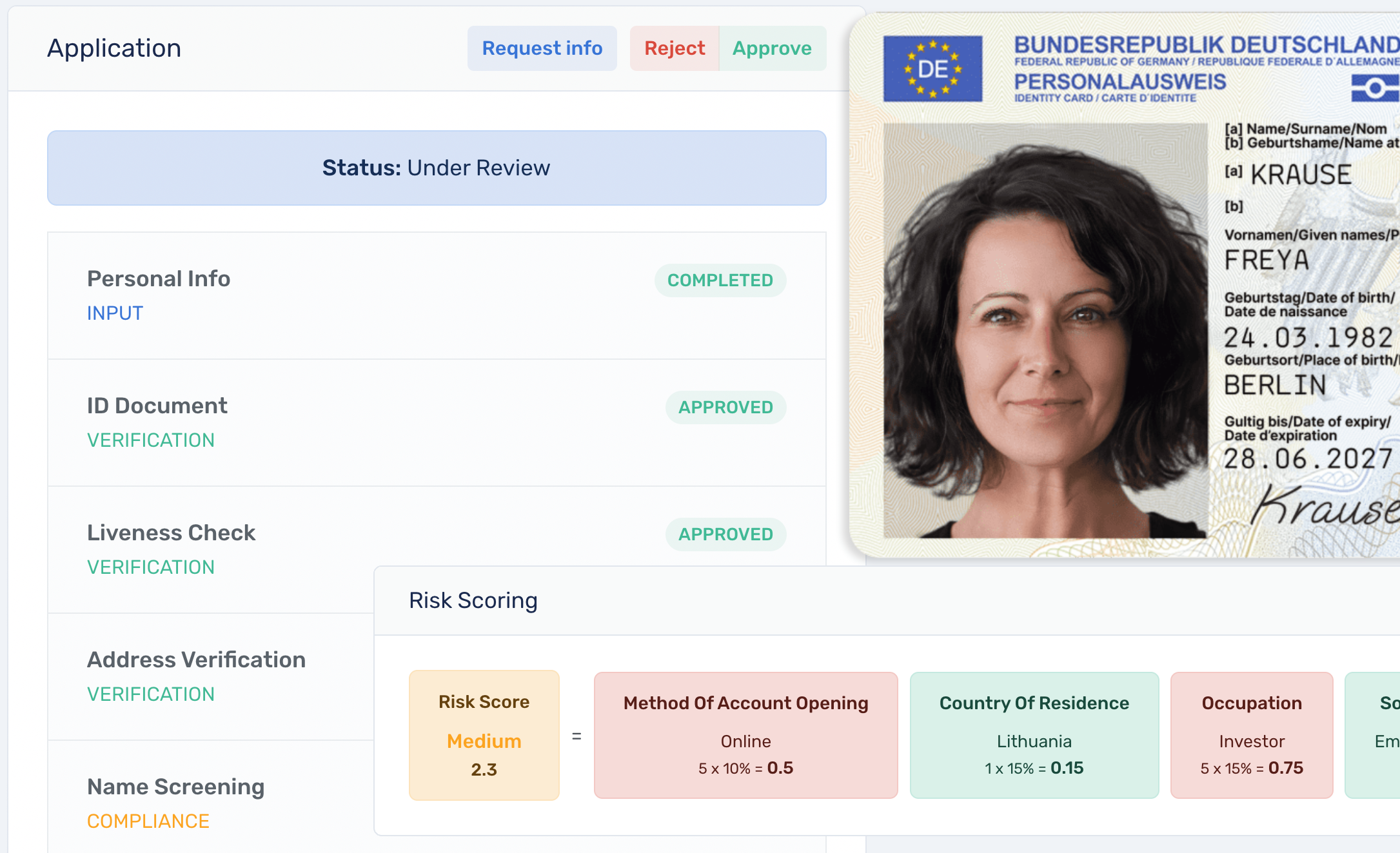

All trades are processed within Aerapass's compliance framework, including AML/CTF screening and transaction monitoring.

For customer-level compliance controls, see the Customer Management module.

Discover the Aerapass platform

Book a meeting

Schedule a Live Demo

Discover how Aerapass can consolidate your payments, FX, cards, and wealth operations into one secure financial platform.