Platform > Module

Card Issuance

Build and operate programmable card programs with real-time controls, deep customisation, and full API access.

THE CHALLENGE

Card programs shouldn't be black boxes

Many card issuers expose only basic features and slow manual processes. This makes it difficult to build differentiated products, customise user experiences, and react in real time.

MEET AERAPASS

Programmable card issuing infrastructure

Aerapass gives you direct access to card issuing infrastructure with full configurability across cards, controls, and user experience.

Built for modern card programs, like yours

Aerapass cards overview

| Card format | Supported schemes | Currency support | Issuance & delivery | Typical use cases | Available for |

|---|---|---|---|---|---|

| Virtual | Visa, Mastercard | Single & multi-currency | Instant issuance | Online payments, wallets, payouts | Individuals, Businesses |

| Physical | Visa, Mastercard | Single & multi-currency | Issued after approval | In-store, ATM, POS | Individuals, Businesses |

| Convertible | Visa, Mastercard | Single & multi-currency | Start virtual, optional physical | Scale virtual to physical | Individuals, Businesses |

Issuance, delivery times, and currency availability depend on jurisdiction, program configuration, and fulfilment partners.

WHAT YOU GET

Operate card programs in real time

Configure once and control everything from one platform, cards, rules, users, and reporting.

Frequently Asked Questions

Common questions about Card Issuance

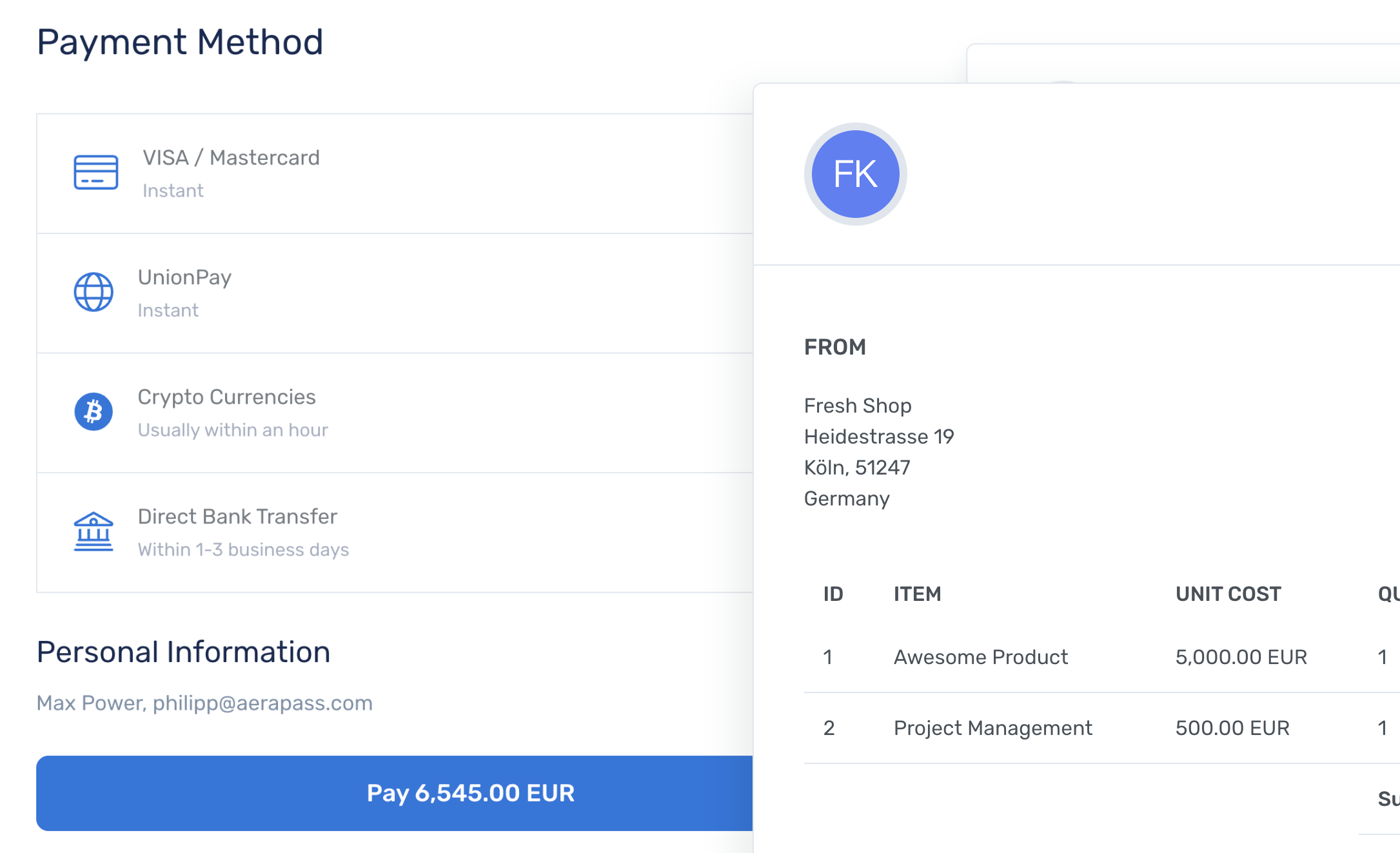

Card Issuance in Aerapass provides direct, API-driven card issuing infrastructure compliant with Visa and Mastercard.

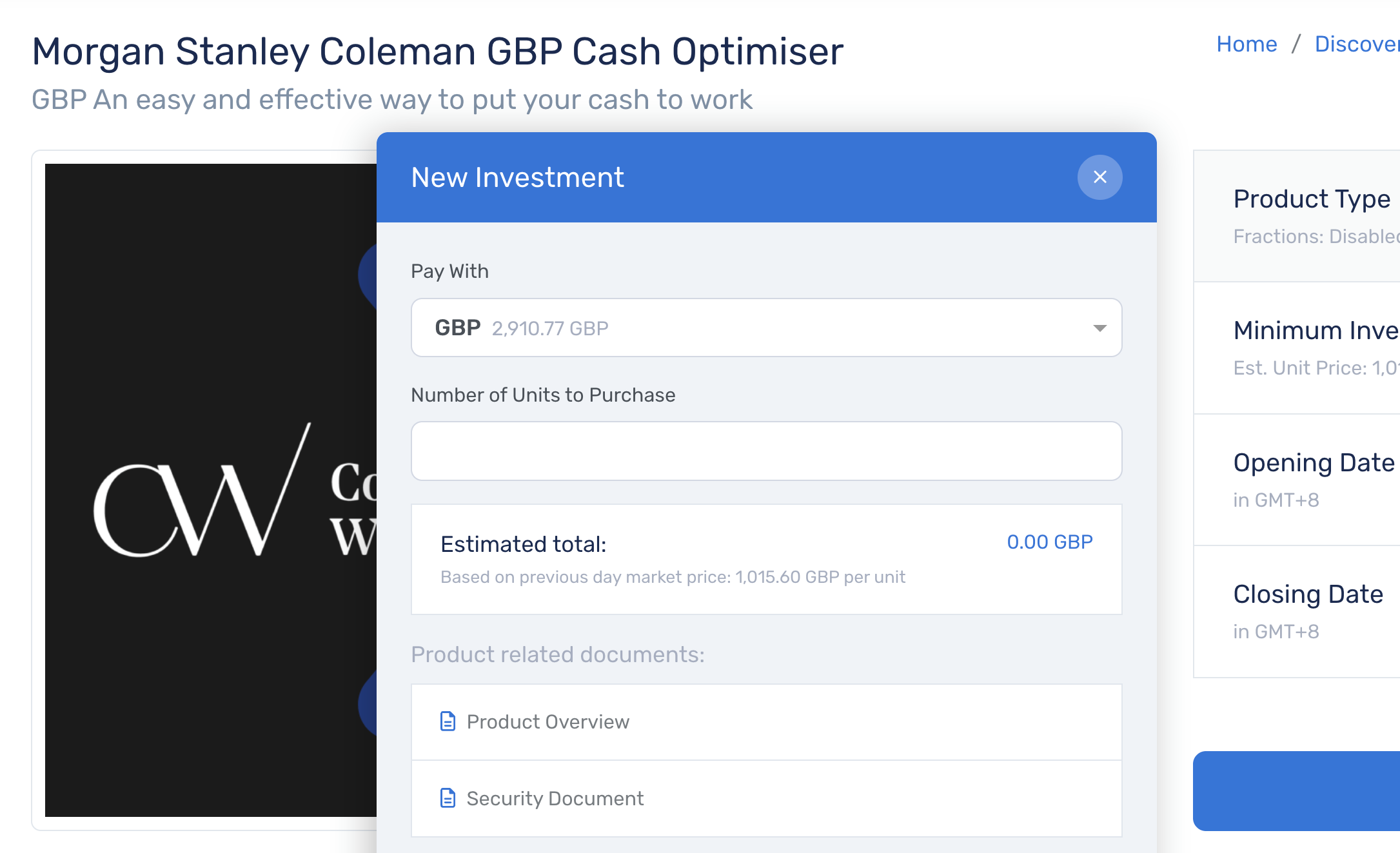

You can issue debit, credit, and prepaid cards and manage both virtual and physical cards throughout their full lifecycle, with real-time transaction monitoring, flexible controls, and custom user experiences.

- Debit cards spend directly from available account balances.

- Credit cards use configurable credit limits that are repaid later.

- Prepaid cards are funded in advance with preset balances.

Aerapass supports all three card types so you can choose the model that best fits your use case.

Yes. Virtual cards are generated instantly via API or dashboard.

Cardholders receive card number, expiry date, and CVV immediately, allowing cards to be used for online payments, subscriptions, and digital wallets without waiting for physical delivery.

Typical launch timelines are 4–6 weeks, including compliance setup, program configuration, and testing.

This is significantly faster than traditional card issuing projects, which often take several months.

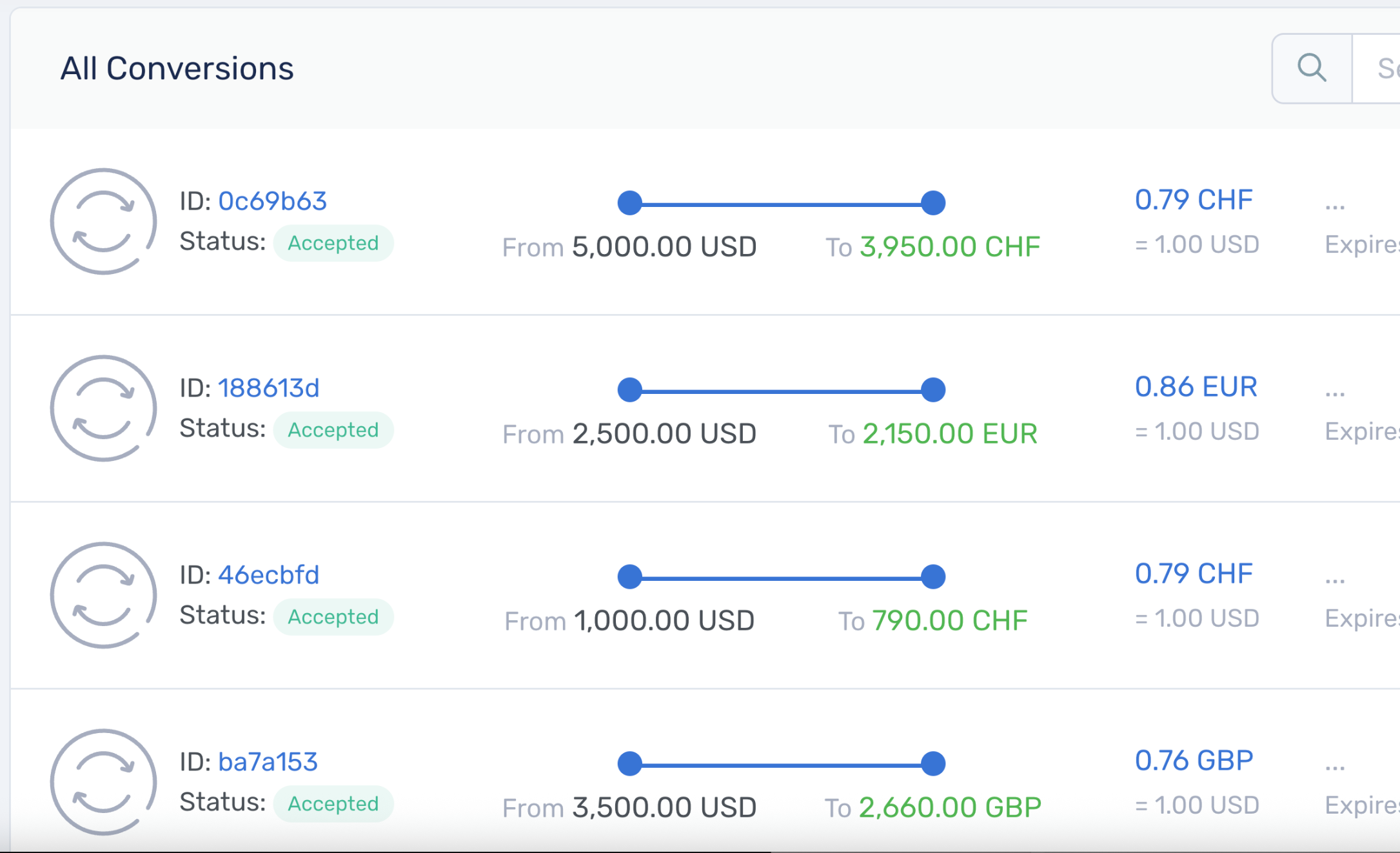

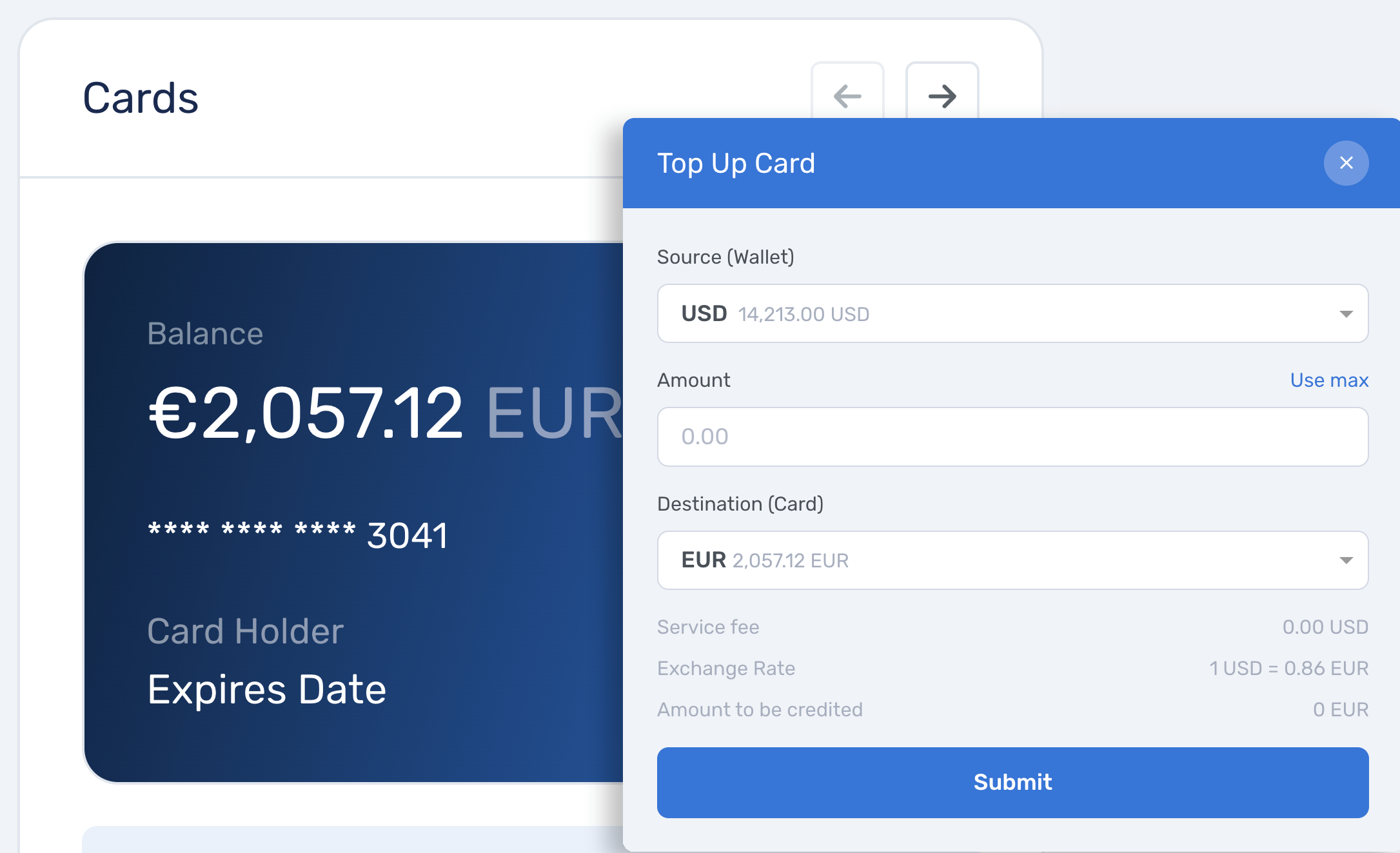

Multi-currency cards can hold multiple currency balances within a single card account.

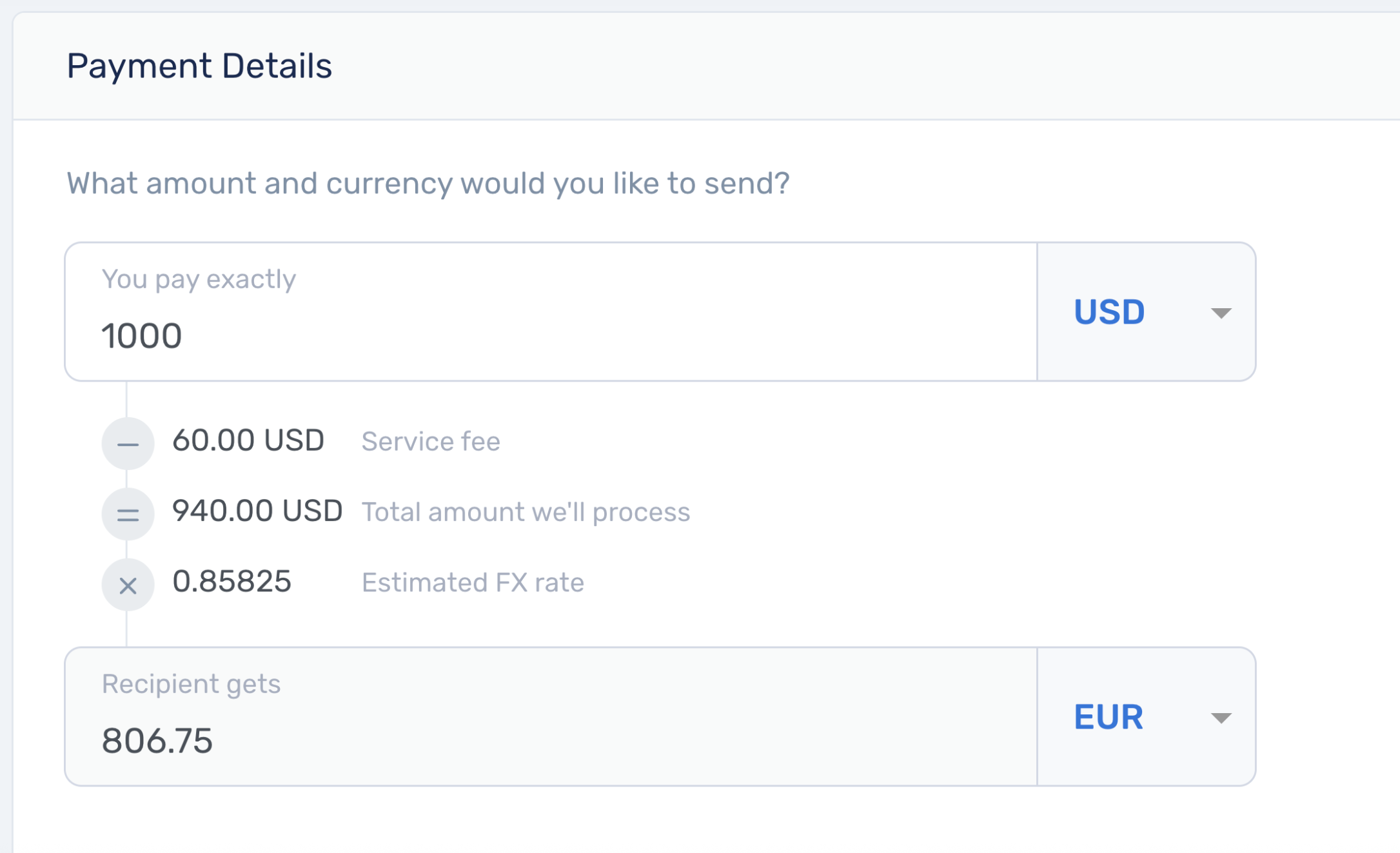

When a transaction occurs, the platform automatically uses the relevant currency balance. If no balance exists, conversion can be applied based on your configured FX setup.

Single-currency cards operate in one currency only and are ideal for domestic programs.

Multi-currency cards support multiple balances and are better suited for international users and cross-border spending.

Yes. Aerapass provides REST APIs and webhooks for seamless integration with your existing systems.

You can embed card issuing into your current user experience without rebuilding your platform.

Fraud controls operate in real time.

You can define spending limits, velocity rules, merchant category restrictions, and geographic controls. Transactions can be monitored live, and cards can be frozen or unfrozen instantly. 3DS authentication and additional verification steps can be applied based on your rules.

Yes. You can fully customise 3DS challenge flows and authentication pages to match your brand and user experience.

Physical cards are fully customisable with your branding, colours, artwork, and logo.

Design options include standard plastic cards, premium finishes, and metal cards depending on your program configuration.

Cards can be used anywhere Visa and Mastercard are accepted, online and in-store, subject to your configured controls.

Yes. The infrastructure scales from small pilots to large card programs.

You can start with a limited rollout and expand as volumes grow, without changing platforms.

No fixed minimums or maximums are imposed by the platform.

Program scale depends on jurisdiction, compliance setup, and commercial agreement rather than technical limits.

You can receive real-time webhooks for:

- Authorisation requests

- Approved or declined transactions

- Card lifecycle events (created, frozen, terminated)

- Chargebacks and disputes

Discover the Aerapass platform

Book a meeting

Schedule a Live Demo

Discover how Aerapass can consolidate your payments, FX, cards, and wealth operations into one secure financial platform.