Platform > Module

Global Payments

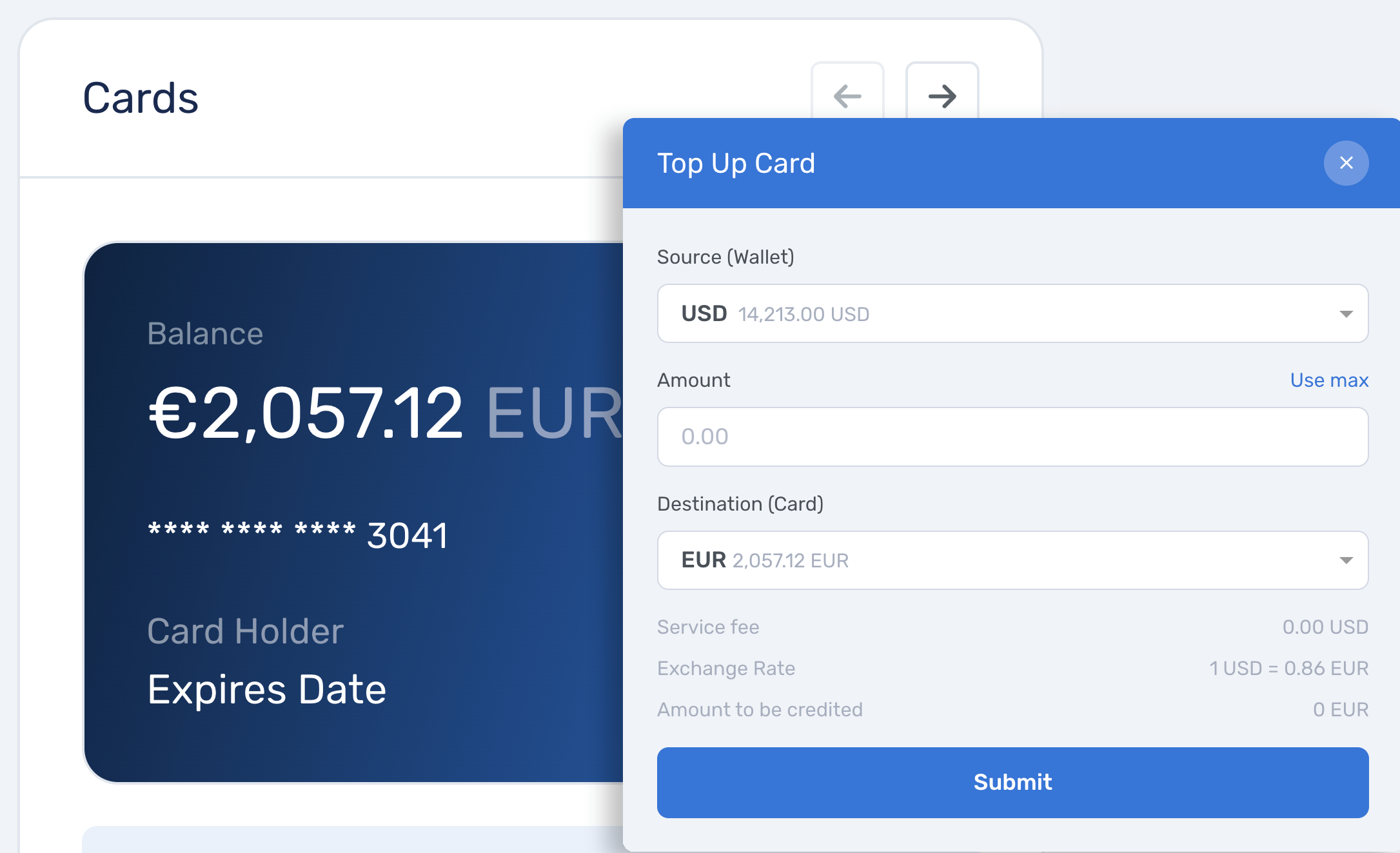

Run cross-border payments across global and local rails, from SWIFT and SEPA to domestic clearing networks, from one platform, improving settlement speed, cost, and reliability across major corridors.

The challenge

International payments shouldn't take days

Traditional payment methods create cash flow bottlenecks and eat into margins. Your business operates globally, but your money moves at a crawl, limiting growth and frustrating partners.

Meet Aerapass

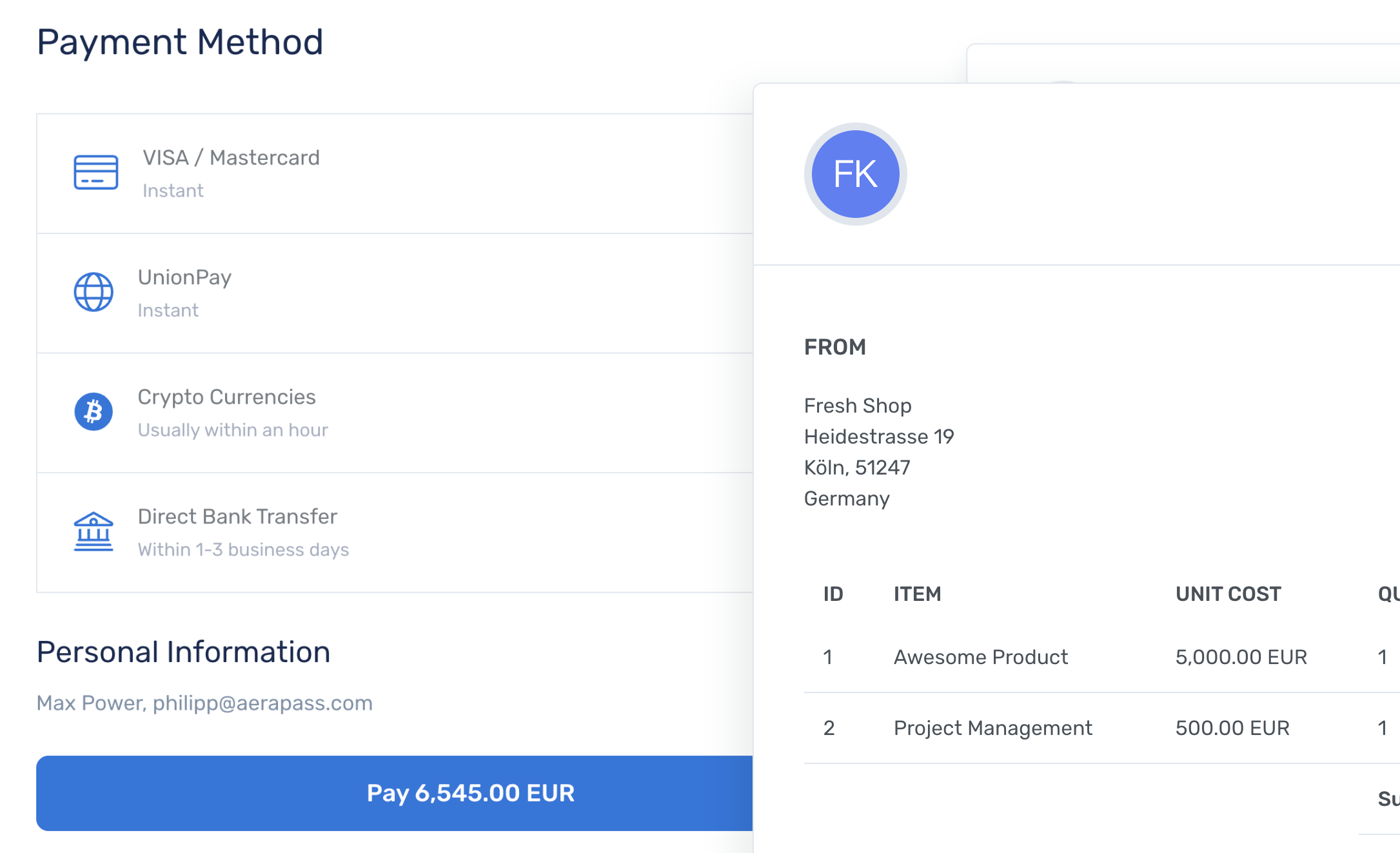

Multiple payment rails & integrated trade finance services

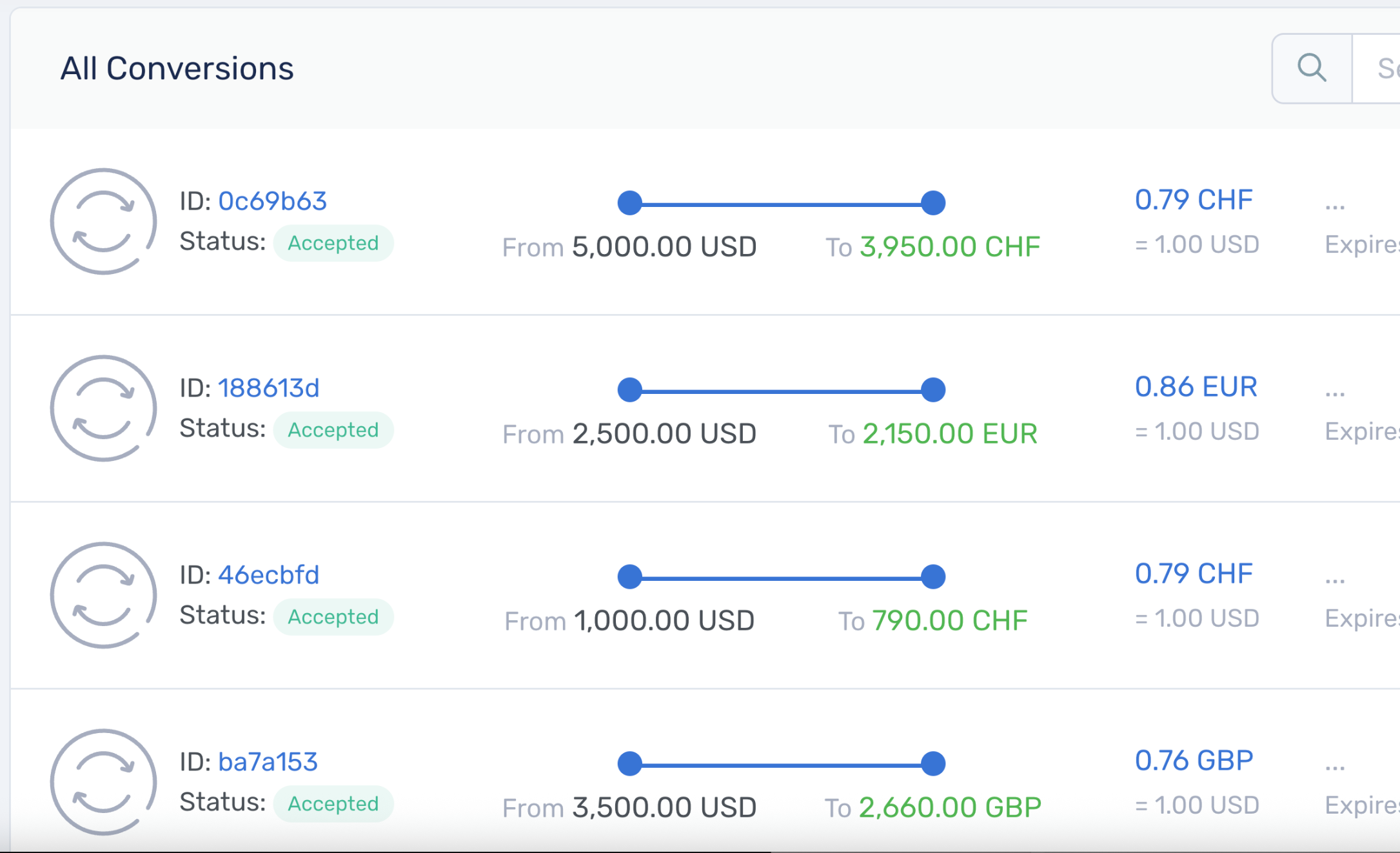

Choose the right payment method for each transaction: SWIFT, SEPA, ACH, and local clearing networks. All available in one platform.

Traditional Rails

Stablecoin Settlement:

Built for global businesses, like yours

Global payments coverage

| Payment method | Primary regions | Currencies | Typical availability |

|---|---|---|---|

| SWIFT (cross-border bank transfers) | Global (EU, UK, US, APAC) | Major global currencies | Same day to 2 business days |

| SEPA (credit & instant) | EU / EEA | EUR | Near real-time to 1 business day |

| ACH (bank transfers) | United States | USD | Same day or next business day |

| Faster Payments | United Kingdom | GBP | Near real-time |

| Local bank rails | EU, UK, APAC (select markets) | Local currencies | Same day |

| Card payments (debit & credit) | Global | Major global currencies | Instant authorization |

| Digital currencies | Global | Supported digital assets | Near real-time |

Availability depends on jurisdiction, currency, and underlying payment partners. Coverage expands continuously.

What you get

Faster settlements, lower costs, better results

Accelerate settlements, lower fees, and give customers faster, more predictable international transfers.

Frequently Asked Questions

Common questions about Global Payments

Global Payments in Aerapass lets you process and manage cross-border transactions across multiple global and local payment rails from a single platform. This includes traditional banking networks such as SWIFT, SEPA, ACH, Faster Payments, and local clearing networks in supported markets.

Each transaction can be routed over the optimal method based on speed, cost, and corridor requirements, resulting in faster settlements, lower fees, and more predictable international transfers while maintaining full compliance.

Yes. Aerapass provides access to traditional banking rails including SWIFT, SEPA, ACH, and Faster Payments alongside local clearing networks and optional digital asset rails.

You can choose the best method for each transaction based on speed, cost, and recipient preferences.

Yes. In addition to global networks, Aerapass connects to local clearing systems in supported jurisdictions through our banking and payment partners.

This allows you to send and receive domestic-style transfers in local currencies, improving settlement speed and reducing reliance on correspondent banking.

API-based integrations typically take 2–4 weeks and include initial setup, API connection, and basic testing.

More comprehensive banking-as-a-service deployments usually require 6–8 weeks and include extended testing and compliance verification before going live.

Yes. The platform is designed for businesses processing high transaction volumes, including thousands of cross-border payments per day.

Our infrastructure supports payment processors, marketplaces, financial institutions, and international businesses that require scalable, reliable transaction processing.

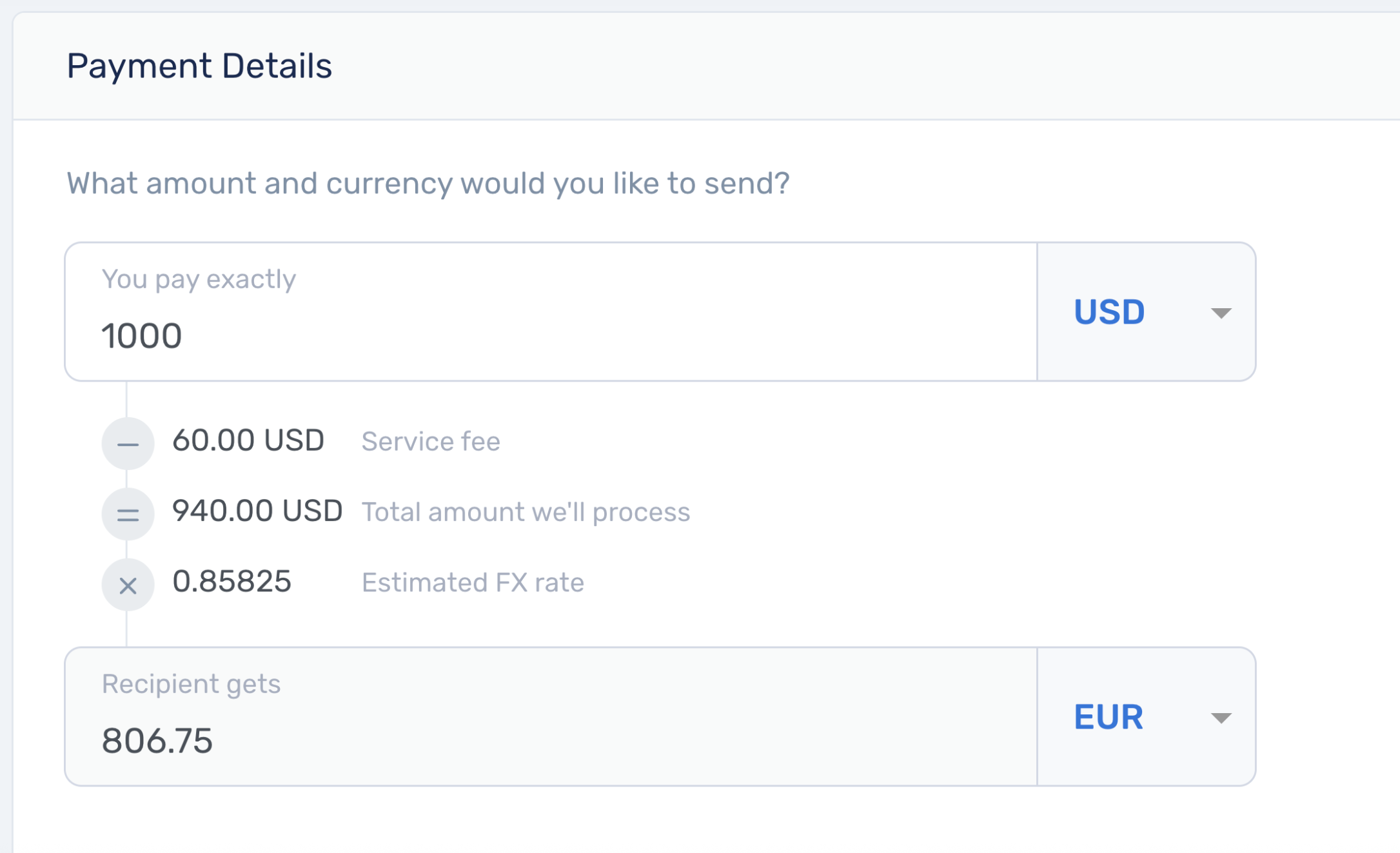

Fees vary based on corridor, payment rail, currency, and volume.

Traditional correspondent banking routes typically involve higher costs, while local clearing rails and optimized routing can significantly reduce fees. Specific pricing is tailored to your use case and agreed during onboarding.

Aerapass provides banking-as-a-service APIs that connect your platform directly to global and local payment infrastructure.

The APIs automate payment initiation, multi-currency account management, FX conversion, and reconciliation. Comprehensive documentation and a sandbox environment are provided to support fast integration and testing.

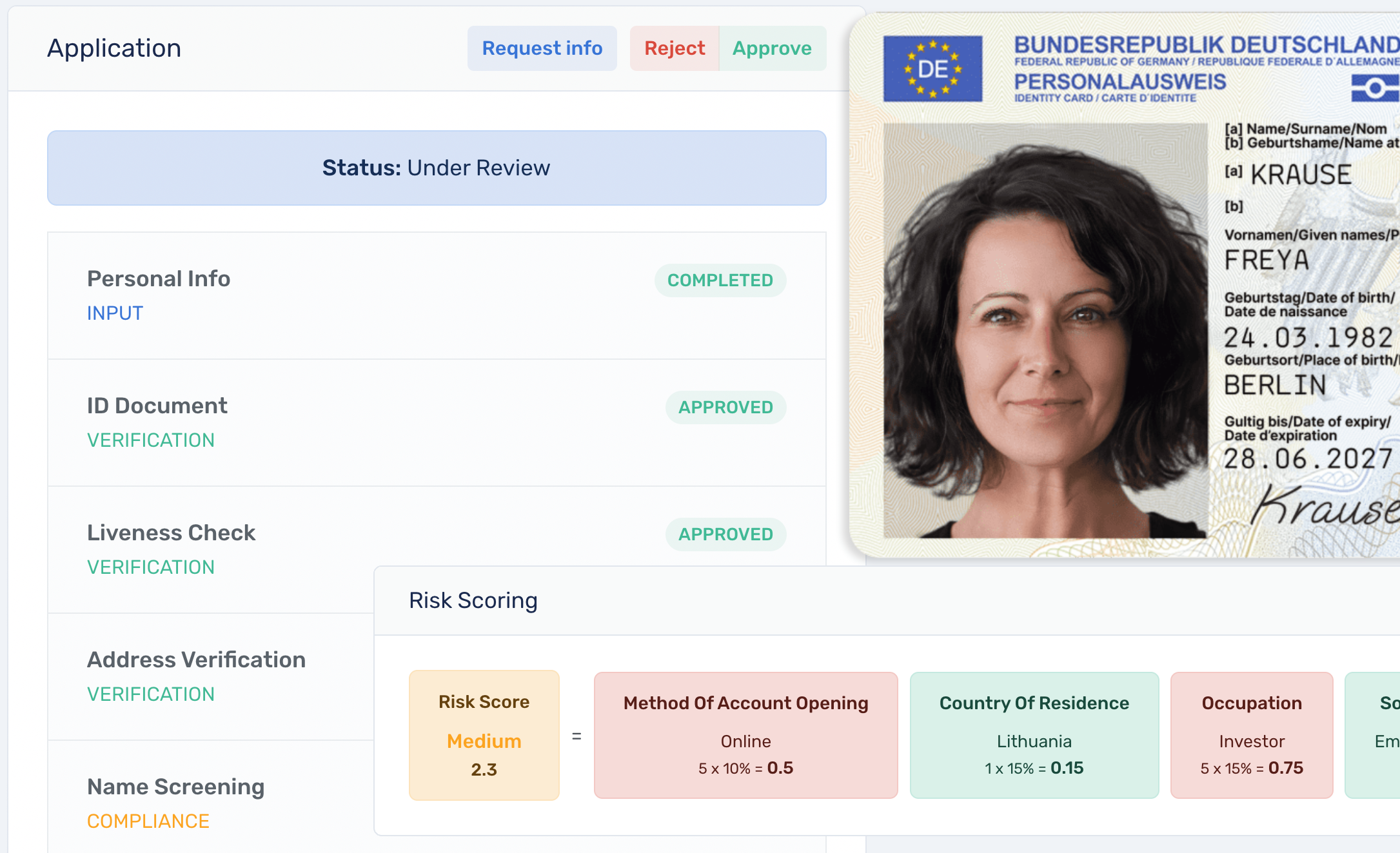

All payments are screened through automated AML/CTF and sanctions screening regardless of which payment rail is used.

Transactions are monitored in real time, and audit logs are generated automatically to provide a complete compliance trail. Customer-level compliance is handled through the Customer Management module.

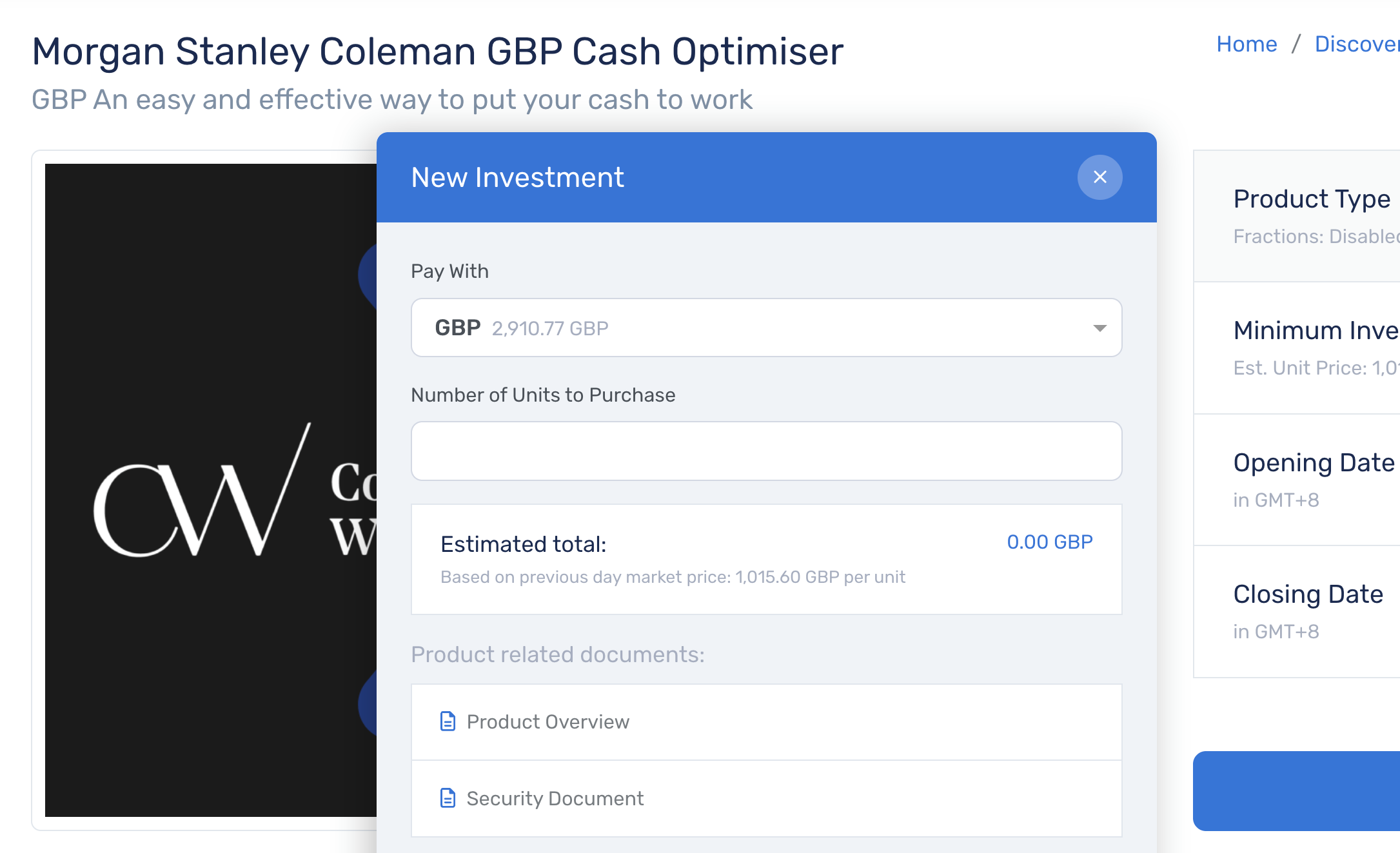

Yes. Aerapass supports optional settlement using supported digital assets where appropriate.

Digital asset rails can be used for specific corridors or use cases that benefit from faster settlement and 24/7 availability, alongside traditional banking rails.

Digital asset settlement is most effective in corridors with strong infrastructure and clear regulatory frameworks.

Availability depends on jurisdiction and partner coverage, and we help determine when digital asset rails make sense for your specific flows.

When used, settlement typically completes within minutes and is available 24/7, including weekends and holidays.

You can track transaction status in real time through the Aerapass dashboard.

Yes. Global Payments uses Customer Management as the foundational layer for identity, profiles, and risk context.

This ensures consistent compliance, monitoring, and auditability across all transactions.

Discover the Aerapass platform

Book a meeting

Schedule a Live Demo

Discover how Aerapass can consolidate your payments, FX, cards, and wealth operations into one secure financial platform.